Ashley Brooks

13th January, 2017

IC Insights

Investment Review Quarter 4 2016

Market Review:

The story of 2016 was one of uncertainty, divide and change. Turning back the clock to the first week of the year, fears surrounding the Chinese financial system were starting to hit markets hard. As the year progressed, we had various Central Bank policy changes, continued volatility in the oil price and then the infamous Brexit bumps in June.

The UK economy had reacted well to the uncertainty produced by the vote, and we’d just started to come to terms with the process of leaving the EU (although the terms “hard Brexit” and “soft Brexit” continue to be thrown around) when another curve ball was thrown in the shape of President-elect Donald Trump. Markets again shook this off though, viewing his bouffant hair style and subsequent change in policy direction as a beacon of hope.

Whilst equity markets across the globe tracked higher (led by the US which returned 11.78% on the quarter), bond markets fell sharply as investors revised their growth outlook upwards on the basis of “Trumpenomics” (a fake term, used to describe his policy agenda). Mr Trump has vowed to increase government spending dramatically, cut corporate taxes and will attempt to get Mexico to pay for the wall… all in days’ work of course. These changes would be good for companies and therefore share prices, which goes some way to explaining the positive market reaction. However, as we will argue in our outlook, there are still some significant hoops to jump through before all this change gets implemented, so investors need to be careful not to go gung-ho.

Sticking with the US theme, Q4 also included the Federal Reserve’s (US Central Bank) first interest rate increase of 2016. Interest rates are normally pushed up to stop an economy expanding too quickly (which could ultimately lead to a bust), but whilst US economic growth is good, it is not booming. Higher interest rates do give them more room to manoeuvre if the country falls into recession however, so from a protection point of view, it’s a positive. On this occasion, markets widely expected the increase, and therefore did not react significantly.

Jumping over the pond to Europe, we had the Italian referendum on constitutional reform to deal with. Italy voted against Prime Minister Renzi, who subsequently resigned the day after. This brings into question the possibility of a European referendum for Italy, depending on the party that obtains power in its general election later this year. The Italian government had a busy three months, as it also had to revise a plan to bail out some of its troubled banks. This boosted their share prices, but there is still a lack of clarity around the situation.

The European Central Bank extended their Quantitative Easing (QE) Programme to December 2017 but also cut the rate of purchases slightly. In simple terms, this supports markets and the economy, one of the key reasons the MSCI Europe (index relating to European stocks) returned 8.1% in just three months.

On the other side of the channel the UK economy typified the term “bouncebackability”, as fears about the potential negative consequences of the Brexit vote receded. Data released from the Office for National Statistics indicated the UK economy grew at a better than expected rate of 0.6% in the third quarter, and consumer spending figures remained resilient. The FTSE All-share joined its equity market peers to post a positive return of 3.9% in Q4, and commercial property regained its form after an uncertain six months. Commodity stocks in particular did well against a backdrop of more supportive Chinese data.

To summarise, Q4 was characterised by political uncertainty out of the US and Europe, good returns for risky assets such as equities, and a bad environment for bonds. 2016 as a year should certainly act as a reminder that predicting the economic outlook is an impossible task. Ensuring the portfolios are heavily diversified and have the ability to perform well in all market environments has never been more important.

Portfolio Review:

If you had sat down with us in mid-February with a crystal ball and said “before the year is out, we are going to exit the European Union and Donald Trump will be the President elect”, cash would have quickly become our favourite asset class. The level of uncertainty produced by those two events would make markets jolt violently, and whilst that could (and subsequently would) be a positive jolt, we would not have wanted to expose our clients to the other side of that coin.

We have never positioned the portfolios on the basis of the outcome of a single event… we are investors, not speculators. Preserving our clients’ capital will always take priority over generating amazing returns, and to get the latter, sometimes you have to take a lot of risk, which by definition means you could lose a lot.

Currency movements are just one form of risk, and they have characterised 2016. To give an example, the FTSE 100 index (a high risk equity market) returned 19.07% in pound terms last year. However, in US dollar terms it returned -0.2% (Source: FE Analytics). Needless to say, you’ve got quite a different perspective on 2016 if you are a US investor. It was weakness in the pound that ultimately drove the vast majority of last year’s stock market returns, not the fact that the FTSE 100 Index was a fantastic investment.

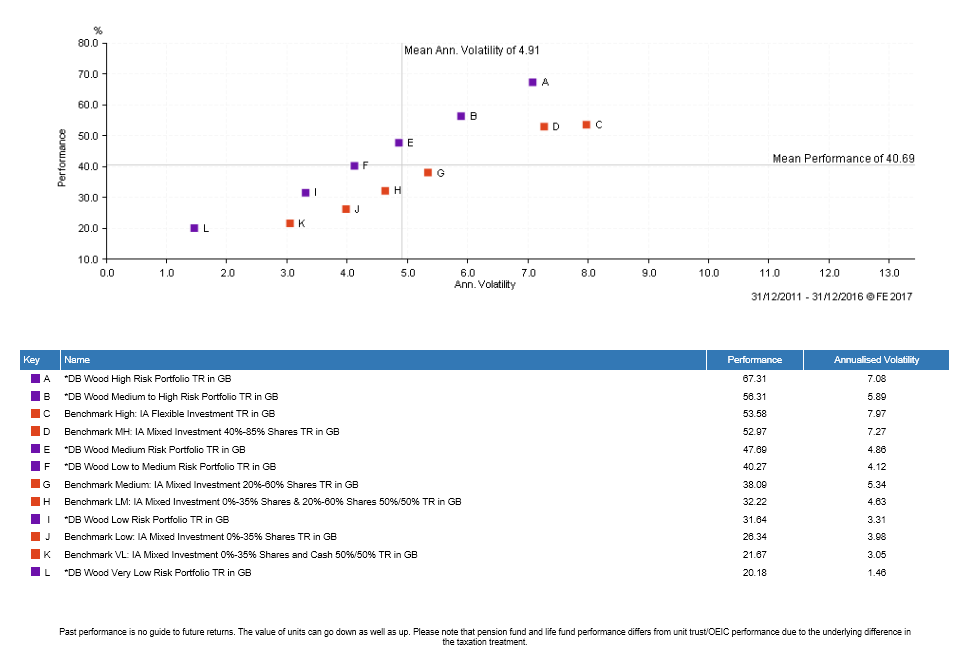

This makes it a difficult environment for us relative to our benchmarks especially towards the lower end of the risk scale, as we do not take unnecessary currency risks. However, we must remind ourselves that it is never our objective to outperform benchmarks, instead the portfolios are produced to maximise the chance of our clients meeting their Financial Planning goals. This year could have gone very differently, and we would have performed solidly across all environments. Of course, one year in isolation is never a good time horizon to compare performance over. On a five-year view, our portfolios have outperformed their benchmarks by an average of 5.64%, each operating with less risk.

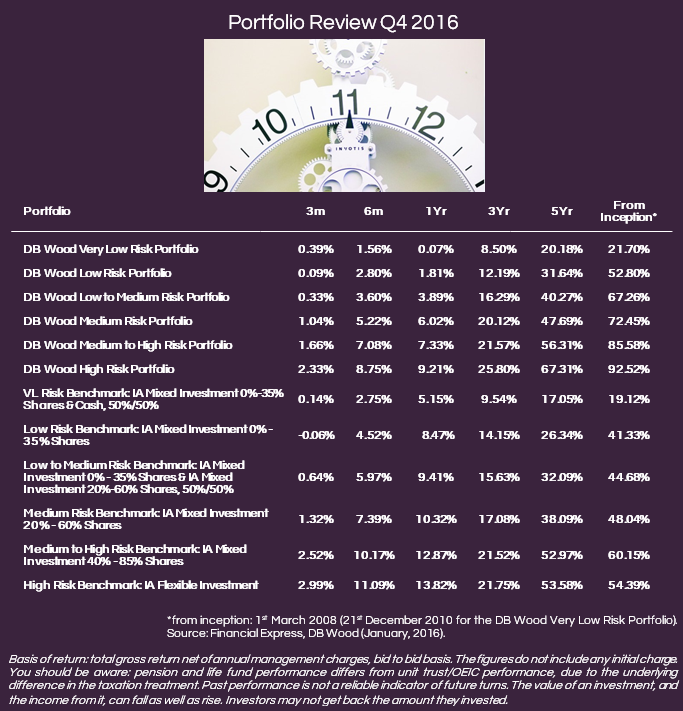

To isolate Q4, it was a good period for the portfolios, as they added between 0.39% and 2.33% across the range. Consistency was the name of the game, as all component parts contributed to the overall gains. Our equities bucket performed strongly as markets rose, Commercial Property regained its solid income profile and our Absolute Return (funds that aim to post small positive gains in all market environments) did exactly what is expected of them.

It was also pleasing to see our Fixed Interest (holdings) bucket perform positively in a significant bond market fall. We have talked about the risks to UK Government Bonds in particular for some time (see our Q2 and Q3 Quarterly Updates), and the asset class lost 5.62% in just 3 months (Source: FE Analytics – Barclays Sterling Gilt Index). This is a great example of not taking unnecessary risks, and whilst we did not participate in the great returns seen in the first half of the year from this asset class, our clients were not exposed to the downside. Instead, our view on inflation started to filter into the UK, with our inflation-linked bond exposures posting solid positive returns.

To round-off with a chart (below), in markets dominated by short-term noise, it is always important to remember the bigger picture…

Market Outlook:

Whilst our base case view for 2017 is positive, political and economic risks remain elevated , therefore cautious and active positioning is key.

A lone individual cannot usually trigger a general macroeconomic trend or a financial market reaction – it takes millions of votes to change the electorate for example. However, 2016 will probably be viewed as the start of a new era of change, and because of that, when making macroeconomic predictions, it is vital to pay attention to the emotion behind recent human actions and beliefs.

Europe will be the next destination to make their stance on the political backdrop. Led by the spirited change that’s been declared in the UK and US; France, Germany, Italy, the Netherlands and more, will all have chance to shape the future of the Eurozone. From an investment point of view, the biggest risks are always those that are low in probability but high in impact, and to this end France and Germany demand our attention (in May and October respectively).

We quite like European stocks for a number of reasons; valuations are cheap, the earnings outlook is positive and they have continued support from the European Central Bank. The probability of Germany or France triggering an EU break-up remains low, but it would be irresponsible to treat it as 0%. If it did occur, it would likely trigger a sharp correction in global share prices, a collapse in the euro and severe global uncertainty. Therefore, irrespective of the potential for good European returns in 2017, we will not be investing a significant portion of our clients’ money there. This example continues to typify our approach to stay away from risk and focus on sustainable areas where we have high convictions.

On a global basis, we are relatively positive about growth, albeit from a very low base. Recent data suggests the US economy will be stronger this year than it was last, and as a generalisation emerging market economies have a much better footing than has been the case in previous years. Even as we move through Brexit talks, we expect activity in the UK to remain solid. There will certainly be companies that perform strongly against this backdrop, and we have good ideas here in equities and high quality corporate bonds.

We allocated heavily to inflation-linked bonds (bonds that benefit as prices rise) last year, and we expect rising inflation to continue into 2017. Whilst this portion of the portfolio is low in risk (and therefore return potential), it should act as a good diversifier. In fact, the portfolios look very well protected against rising inflation overall, as Commercial Property prices are usually inflation protected and our equity ideas are in areas that will benefit.

This outlook seems positive then, and it is to the extent that we believe the portfolios are positioned strongly. However, we are certainly not re-writing our cautious stance. The growth outlook is positive, but stock markets around the world are already trading at or near all-time highs. Mr Trump has already demonstrated his innate ability to cause controversy just through social media (can’t wait for him to be in office), the European situation requires both eyes, we have Article 50 to negotiate and currency markets will remain volatile.

Our objective remains the same, to maximise the chance of our clients meeting their financial planning objectives. To do this we will focus on balancing core equity and bond exposures to alternatives such as property and absolute return. Gold continues to act as the portfolios’ insurance policy, and should perform well if any of the key market risks are realised. It’s the opposite of all eggs in one basket for us then, as we look to control risk diligently and make money where we see it is sustainable.

It is always our privilege to manage our clients’ money, and we will continue to strive to make it work as hard for them as possible but as always, with the appropriate protections in place.

Categories

Recently Written

Join our mailing list