Ashley Brooks

14th July, 2016

IC Insights

Investment Review Quarter Two 2016

Market Review of Quarter 2:

Our expectations for 2016 of low growth, low interest rates, lots of headwinds and regular bouts of volatility continued into quarter two. Speculation surrounding “Brexit” was the key theme in global markets and with equities rallying in the lead up to the June 23rd vote, a strong start to the period was reversed by the Brexit shockwave.

It seemed every man and his dog had expected a strong vote for remain which left a lot of people invested the wrong side of that bet. Stock markets fell in the immediate aftermath, the pound suffered tough losses and government bond markets became yet more expensive.

As Mark Carney (Chairman of the Bank of England) explained in the days following the vote, markets functioned robustly throughout the volatility, providing reassurance that we are not in the same situation as we were in 2008. In fact, since the initial falls, equity markets have rallied back hard on the basis of Central Bank support and in broad index terms are now higher than they were on June 22nd.

It’s important not to take the performance of indices like the FTSE 100 at face value however, as under the bonnet assets have rotated significantly. Banks and Housebuilders for example, have lost 20% in a month, whereas other stocks like Randgold Resources gained up to 30%. This divergent performance should act as a reminder that diversification is key through challenging market environments such as these.

To round-up other asset classes, Commercial Property was the worst hit by the Brexit vote, as the uncertainty kicked funds into a period of redemptions and re-pricing. After 3-5 years of stellar returns, the saga ended in a suspension of trading across most funds, as they looked to protect existing investors from a stampede to the exit. Government bonds on the other hand performed strongly, as investors speculated on furtherr interest rate cuts here, and a holding of rates in the US. To put it into perspective, 10-year UK and German government bonds now offer returns of 0.81% and -0.1% per annum respectively (in the case of the latter, you’re paying them to borrow your money).

Currency positioning has never been more important than in the current environment. To illustrate, the Japanese market fell 7.4% in Q2, but the sharper appreciation of the Yen (Japan’s currency) reversed this for UK investors as they made a return of +6.1%. Much of our Investment Committee debate over the last 18 months has surrounded the rationale for hedging (removing the risk) or un-hedging various currencies, and this decision was a benefit to our portfolio’s in the aftermath of Brexit.

Overriding, quarter two acted as a reminder that nobody has a crystal ball, and therefore active portfolio management and consideration of key global risks should remain central to any investment portfolio. Different assets remain closely connected, to the point where a European event such as Brexit will drive all markets. In this environment, it is always important to keep grounded and remember the longer term picture. We believe that some opportunities have and will emerge from Brexit, but that these might take some time to play out.

Portfolio Review:

One of our core processes in portfolio management is constructive self-evaluation. For example, we constantly analyse what has performed strongly and what has detracted. It is good practice to do so. Ultimately though, as things turned out, the UK referendum dominated the quarter. Markets initially rallied as they had priced in a vote to remain, but at the same time were starting to look to other areas of the globe, speculating on the next cycle of interest rate rises in America. Had the UK voted to remain, Government bond prices would be significantly lower and property should have taken another leg upwards. The US could have decided to raise rates the week before but didn’t, and the Spanish election could have gone differently instead of remaining in deadlock. Our portfolios were not positioned to specifically protect or benefit from a Brexit, but instead contained strategies that would do well in a variety of scenarios. Some were tactical and therefore short term, but the majority positioned where we see the best value longer term. As we know, the vote to exit was a surprise to investment markets, and has already led to asset classes providing us with a different set of challenges.

On the positive side, our defensive equity stance benefited from flows out of smaller companies into larger global corporates. Our conscious decision to keep currency exposure unhedged meant that overseas assets returned strongly in sterling terms. We did reduce our commercial property exposure in May, although with the benefit of hindsight we would have been better to make this change in quarter1.Nonetheless, commercial property remains a key sector moving forward, with yield of more than 3.5% and a robust tenant base, it will continue to play a key role in the portfolios, even at a lower weighting.

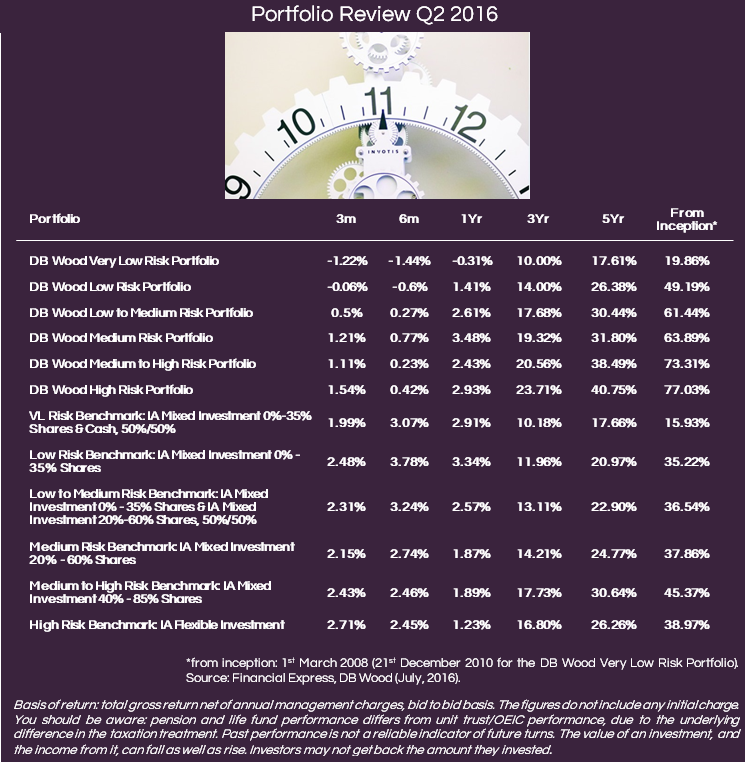

Those of you who have followed our publications for some time will have noted that even in the best of times we do not like to compare ourselves to benchmarks. The reason is because we do not set out with the goal of beating them, and instead run portfolios to meet financial planning objectives. Our return targets are set over a rolling five-year time horizon, which is a more appropriate timeframe to measure performance over, as it negates a lot of the short term inefficiencies.

We feel it would be irresponsible to ignore the fact we have underperformed our benchmarks over the last 3-6 months though; we are lagging significantly. Government bond prices have continued to rocket, with most developed markets pricing in a global recession. Our benchmarks hold a significant proportion of these assets; 26% in the Low Risk Benchmark as an example. In contrast, our weighting is near zero across the portfolio range as we continue to see large risks associated to the asset class.

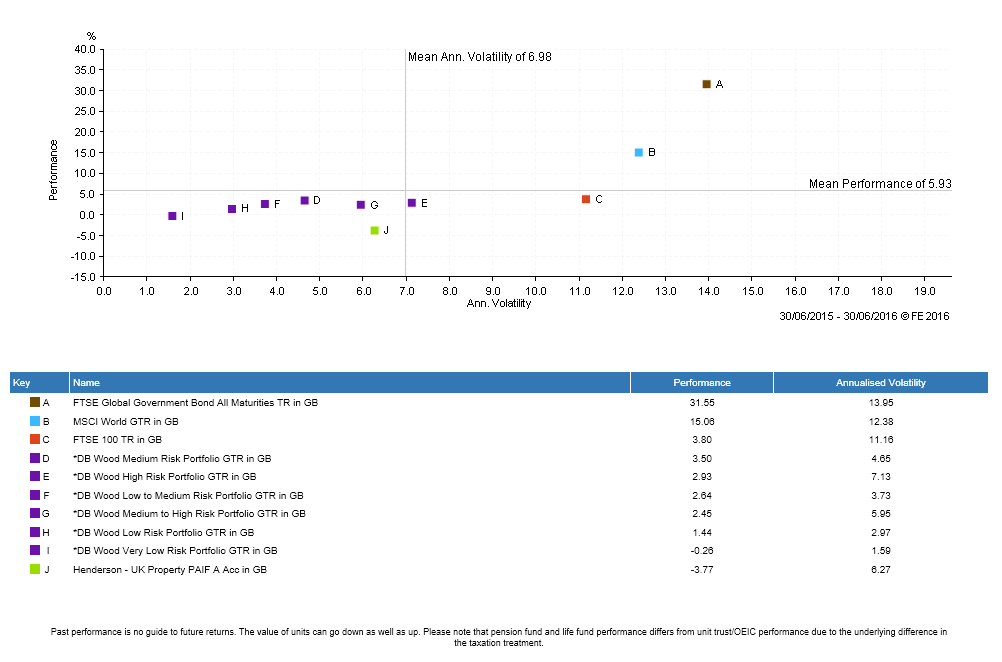

The status of Government bonds as a “safe haven” asset is highly concerning at this time. This status would suggest that volatility should remain low and protect capital if the world is in a tough spot. The chart below shows that this is not the case; the volatility of ‘A’, a government bond index, is twice that of our High Risk Portfolio! We are not in the business of buying assets that offer a 1% return, hoping that a greater fool bids them up further. Despite the recent strong performance, we are well and truly in the camp of “past performance is not a guide to the future”.

Despite our significant reductions pre-Brexit, our property exposure has reduced performance, albeit slightly artificially. To summarise, funds have now employed a number of measures to protect existing investors (like ourselves) from outflows, which has reduced performance by circa. 11%. Despite this, the 3 year return to the end of the quarter from this sector was circa 20% (after costs) from our three main holdings. Moving forward the investment case for investing in property remains compelling, and hence we did not remove completely in May. We remain happy that the income yield of circa 3.5% across our exposure represents an attractive return for the underlying capital risk.

With respect to overall portfolio risk, controlling volatility is always a key challenge in difficult market environments. It demonstrates an ability to minimise downside risk for our clients who don’t want to be seeing large changes in value from one day to the next. The chart demonstrates that we have achieved this over the last twelve months (the further to the left, the lower the volatility levels), a period that includes Brexit. Although we have not been invested (for the right reasons) in the places that have generated the best returns (government bonds), our management of risk has been exceptional, which will provide good opportunities when our ideas start to play out.

Market Outlook:

It’s a balancing act. Brexit fallout, strengthening but maturing US economy, fiscal and monetary stimulus, inflation… all this and more needs to be considered in the second half.

As important as Brexit still is, there are many more global economic issues that remain central to returns moving forwards. Part of the reason for recent equity strength has been the data coming out of the US. Strong jobs numbers alongside the increased likelihood that the Federal Reserve will not raise rates again this year has buoyed equity markets across the globe. Underneath though, corporate profitability and wage growth look benign; a trend we expect to continue across the developed world.

Low growth and expensive equity markets then… not ideal? In fact, much of the equity market strength (and government bond market strength for that reason) is based on looser monetary policy expectations i.e. cutting or holding off interest rate increases, or quantitative easing. The objective of this type of policy is to stimulate economies, however, we see the effects of this diminishing. Instead of helping to boost growth, it will likely just support markets, causing the disparity between the valuations of equities, government bonds, and actual prosperity to become greater.

This means you have to look deeper than broad indices to find good opportunities. There are still great company stories out there, those that will grow irrespective of the political backdrop. In this respect, our focus is on selecting the best fund managers to find these ideas.

Short term, we expect UK inflation levels to rise. The oil price weakness that was seen between last August and January will start to fall off the annual curve in the next six months, so numbers will start to illustrate more stable pump prices. Recent sterling weakness will also add to the investment case as it pushes the price of imported goods up. Although we aren’t talking about “good inflation”, the type that’s created through increased spending and investment, “bad inflation” still creates investment opportunities. We started building a position in index-linked bonds in May (they benefit from increased inflation) and will continue to do so in the coming months. It is important to note that this is a tactical position, and that we don’t see prolonged inflation, but subdued inflationary levels in the UK and globally longer term.

There is also a compelling investment case for gold at present. The yellow metal sits significantly below its 2014 highs, and could benefit both in an inflationary (rising prices) and deflationary environment (falling prices). If we do get any economic weakness, with government bonds not offering much in terms of upside (and lots of downside!), gold could be one of the only true safe havens available. The only scenario where this doesn’t perform is where the US economy is buoyant, but in this environment our equity plays will more than compensate.

In summary, we have turned more positive on selective fixed income due to elevated geopolitical risks and easy monetary policy in a low-growth world. We like income, including good quality companies and UK commercial property, where yields are sustainable. We are cautious on equities, given expensive valuations and poor profit growth and we like gold as a portfolio diversifier. The last point remains crucial, as diversifying your risks and sources of return remain a central mandate.

As an Investment Committee, we continue to strive to work hardest for clients in the challenging times, and although the return environment is now more difficult than it has been in the past seven years, there are still some exciting opportunities available. We will remain nimble and active, protecting the downside and implementing our best ideas where appropriate. Over the medium to longer term we remain confident that we will achieve great results, but patience in the short term is required.

Categories

Recently Written

Join our mailing list