Ashley Brooks

11th October, 2016

IC Insights

Investment Review Quarter 3 2016

Market Review of Quarter 3

After a volatile start to the year, investors were hoping for some consistency over the summer months, if only to take a breath and take in all of the change. Markets had absorbed the Brexit vote and Greece, China and the oil price crash were firmly in the rear view mirror. Surely now we could start to galvanise a direction of travel for the global economy?

Attention quickly turned to the various Central Bank meetings to provide such insights. Mark Carney (Chairman of the Bank of England) kicked us off by implementing one of the biggest stimulus packages the UK has ever seen. This included a further reduction in interest rates, which now sit at the lowest level in history. His justification… “there is a high probability the UK could enter recession if we don’t act”. So far though, data has indicated the opposite; consumers have continued to spend and the weaker pound has boosted exports. After a torrid 12 months, even the UK manufacturing sector has shown some improvement.

Over to the US and we had the widely anticipated Federal Reserve (Fed) meeting in September. The worry for markets was a tightening of policy via an increase in interest rates – they don’t like this because it tends to reduce how much people spend in the economy. However, this did not materialise, as they elected to see out the Trump vs Clinton debacle before making changes. Going into 2016, expectations were for four rate increases this year, but at most they will now stick to just one. Quite simply, we haven’t seen the buoyant economic growth that is required to sustain higher interest rates for long periods, so although we still may see a hike in the next few months, the interest rate environment still remains “lower for longer” in our view.

Within a few days of the Fed’s meeting, we also had some news out of Japan, as their Central Bank also decided to offer more economic support. The kind of stimulus employed in Japan has had bad consequences for their banking system, so hopefully this is a lesson for the rest of the world.

So with our rhetoric focussing on Central Bank meetings you are probably sat there thinking “are these meetings all that matter?” For markets, it seems so. They pay less attention to the important stuff like company results, and more to what policymakers are eating for breakfast! It is quite disconcerting, because whilst markets have continued to perform well into the second half of the year, it has been based on Central Bank support rather than better economic progress. There is an old saying; “sell in May, go away and come back on St Leger day”, which eludes to a myth about markets performing badly over the summer period. This year the saying didn’t hold true, with the FTSE 100 returning 5.68% over the quarter and global government bonds adding another 3.22% to a stellar first half of the year (Source: FE Analytics, October 2016). Irrespective of whether these returns are justified or not, for us there is definitely more to the world of investing than Central Bank meetings, which typifies the short term approach that we strive to avoid.

Moving away from policy meetings, UK Commercial Property funds finished a difficult quarter with trading suspended. Despite this, the marketplace has been robust, with all our fund groups receiving good prices on properties sold post-Brexit. There are a number of indicators that point to good future returns, including tenant demand, which has remained healthy. Overseas investors have also become more interested, primarily due to the weaker pound.

Indeed, currency exposures have also been a core driver globally in Q3, with overseas markets performing strongly, especially in pound terms. For example, our currency has depreciated nearly 20% against the US dollar since June 23rd, which has boosted the returns for UK investors holding US companies. We have for some time viewed currency as a key consideration in any investment decision, but rarely has it been as prevalent as it is today.

Portfolio Review

As detailed in our July review, our cautious stance on government bond markets had restricted the returns of the portfolios over the first six months of the year. We were positioned to protect investor capital, citing various risks in these markets that remain extremely overvalued, and as such had underperformed our benchmarks for the first time in many years.

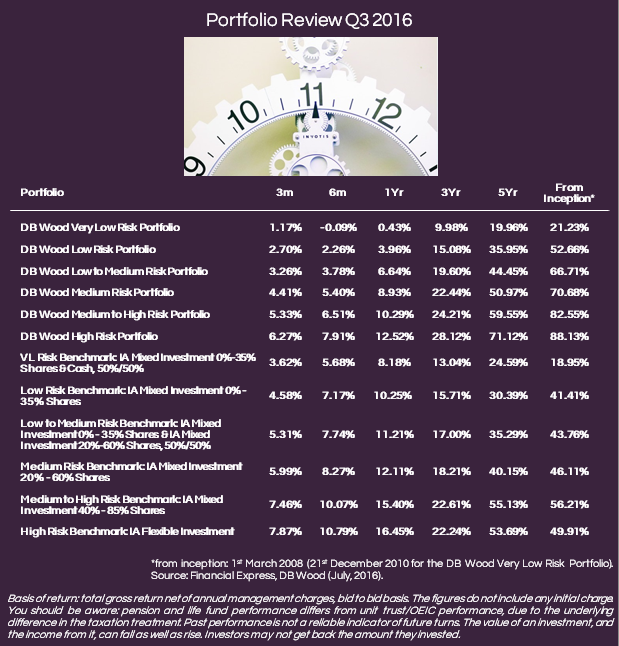

Despite some of the same trends persisting, quarter three was much more positive, with the portfolios adding between 1.59% and 6.27% over the period.

To start with the drawbacks, Government Bonds continued to appreciate in value, therefore boosting the performance of our lower risk portfolios’ benchmarks. Our view on this asset class remains the same; highly unattractive valuations and a high risk of significant capital loss, mean we cannot justify a significant holding.

Our property exposures also pulled negatively on performance, as the funds made changes to restrict the effects of investor panic from Brexit, (the levels of capital outflows were far more significant than in the 2008 property crash), which ultimately led to a suspension of trading a few weeks later. To date, this has cost the portfolios between 0.3% and 0.6% across the range. However, we would expect this to reverse over the next few months. As you will see in our outlook, we remain optimistic about UK Commercial Property over the longer term, and are happy with our allocation after reducing it significantly in April. The current exposure level sits around our long term average, and with compelling reasons to invest, this will remain part of our strategy for the foreseeable future. Although this has hurt us short term, it is always important to retain perspective. Property is an asset class that has been highly profitable for us in recent years, even after allowing for the set back. On a forward basis, our holdings are yielding around 3% to 4%, so we feel that on a risk-reward basis this remains a sensible trade off.

On the positive side, we remain well diversified across geographies, sectors and investment styles within our equity holdings, all of which performed well as equity markets rallied (the FTSE 100 for example, returned 5.68% over the quarter). Overseas equities in particular did well relative to UK holdings, as their currencies strengthened as the pound weakened. Our European and US positions specifically were very positive, helping all portfolios but more so at the higher risk end where we had larger allocations. Moving forward, valuations in these markets are not as attractive as they have been in the past, but selectively there are still good opportunities.

Whilst we remain cautious towards Government Bonds, increasing our Corporate Bond positions in July was also well rewarded, as they provided steady and consistent returns throughout Q3. In particular, we talked extensively last quarter about our expectations for increased inflation (rising prices) in the UK. Accordingly, we had taken a sizeable position in inflation-linked Corporate Bonds, which benefit from rising inflation unlike normal bonds that suffer. As the first few signs of rising inflation have come through, the portfolios have benefited.

To summarise the market environment so far in 2016, it has been one which, so far, has rewarded assets with already expensive valuations. Central Banks continue to manipulate the core equity and bond markets, causing price bubbles and increased risk. Such markets have risen higher, and our defensive positioning has meant we have missed the associated performance. This has been frustrating at times, but the risks remain too high for us to expose clients’ capital to them. We continue to focus on diversifying across all asset classes, and holding what we believe to be true safe havens. This is absolutely required to meet financial planning objectives, and whilst our benchmarks may continue to outperform in the short term, we believe they are holding the potential for a lot of downside.

In times where our portfolios appear to be underperforming, it is important to remind ourselves of our objective. This does not change; we strive to deliver consistent performance by avoiding the main market risks, taking advantage of the opportunities where they are presented, but only when they come with acceptable levels of risk.

Market Outlook

A change in policy is in the air, some forgotten risks and the prospects for more of the same…

There are a number of central themes emerging that are shaping our outlook for the coming months:

Politics

It is becoming increasingly important for investors to understand the ever-changing political agendas; due to the increased influence they are having on market activity (whether justified or not).

Over the course of the next few months, the vast number of political events include the following; there will be a new President of the United States; the Italian electorate will vote in their constitutional referendum (defeat for the current prime minister may well lead to more disarray within the wider Europe); the UK may have triggered Article 50 to begin negotiations for exiting the EU; there will be a new Dutch Government; and the French presidential election campaign will be approaching polling day! Each of these events carry substantial risks, with populist, polarised and fragmented political forces heightening the uncertainty of the outcome and the aftershocks.

Aside from political events, we also suspect there will be changes made to the type of economic stimulus employed. As Monetary Policy continues to disappoint (ultra-low interest rates are having little positive effect), focus will likely turn to increases in Government spending (Fiscal Policy) over the next 12-18 months. Spending will likely be focussed on infrastructure projects, such as improved transport links, which should benefit many companies operating in these sectors.

Politics is becoming more important for investing and whilst there has always been a complex interaction between political risk and economic growth, understanding the relationship has never been more important than at the current time. Upcoming events will inevitably increase market volatility, and any policy changes increase investment risk in the short-term. That said, long-term opportunity is also created for selective investors, who are able to successfully balance the risk vs. reward of global politics.

Equities

It is now eight years since the failure of Lehman Brothers and the economic recovery is maturing; most evidentially in the US. Although on the whole this is viewed as a positive (strength in the US economy is indicative of strong growth globally), it has also caused a number of asset classes to become overvalued. This in turn increases the likelihood of sharp falls in these areas and a resulting possibility of constrained returns over the coming months.

Fears over an imminent recession in the UK and Globally have subsided recently, and we think investors will continue to own equities despite the poor prospect of share prices increasing markedly. UK equities look particularly attractive, as do some global smaller companies. However, we have observed a number of worrying tactics used by companies recently that reinforce the need for caution and selectivity. For example, some companies have been maintaining their dividends (by raising debt) despite falling profits, in the hope of preventing their shareholders selling, which brings into question the sustainability of yields.

With the chance of market falls and potentially unsustainable dividends, our view on equities remains selective, diligent and flexible.

Property

UK Commercial Property has had a tough time over the last quarter but it now looks fair value. Property continues to offer a strong and steady income stream, which is an excellent tradeoff for the risk taken. If, as we expect, a UK recession is avoided, we would predict returns of between 3% and 4% per annum from this asset class.

Bonds

Outside of (overvalued) Government Bonds, there looks to be some good opportunities in bond markets. Our position in UK Inflation-Linked Bonds should continue to do well if short-term inflation continues to trend upwards (we expect it will), as will good quality Corporate Bonds where the income stream is robust. We will continue to use our bonds bucket to obtain sustainability and diversification, but again, there is a requirement to be selective.

Conclusion

While continuing to own the major asset classes, we are taking the risks seriously. The outlook for politics and a continued risk of recession will be watched particularly closely. The clear implication is that investors should remain heavily diversified, and with bond and equity valuations remaining expensive, a considered allocation to absolute return funds (those that look to generate small positive returns in any market environment) is important.

In short, our outlook is to be aware of the risks, defensive against the chance of capital loss, and selective in key markets where there is clear opportunity. Our investment philosophy is such that in times of increased uncertainty, we are able to remain calm and look through the ‘noise’ and as always, we will continue to do our best to provide our clients with sustainable growth not just over the short term, but importantly over the years ahead.

Categories

Recently Written

Join our mailing list