The Planning Team

5th January, 2024

Blog, IC Insights

Q4 Market Review

2022 was one of the most challenging years for investment returns in recent history. As so often when asset valuations fall significantly, there are some excellent opportunities created, and we spent much of the latter part of 2022 in particular, reshaping our portfolios for 2023. As a result, we felt that we entered 2023 with a portfolio full of potential. The key driver for that to be realised would be slowing economic growth, falling inflation and a change from the interest rate narrative that had seen cash rates go from close to zero to 3.5% by December 2022.

The start of 2023 began well for our portfolios with markets pricing in a global recession which supported slowing inflation and a peak in interest rates. After a promising January however, key data points remained stubborn, particularly the inflation numbers but also with respect to wage growth. Interest rates continued to rise (in the UK to 5.25% in July) and our convictions were being tested all the way into the summer.

The catalyst for improvement was always going to be an easing of inflation pressures, though as we entered the final quarter of 2023 inflation in the UK remained stubbornly high at 6.7%. Looking forward however, the energy price cap was being reviewed in October, and a number of other key data points (such as food costs), were suggesting inflation was on the slide. By the end of November inflation was down to 3.9%, an improvement beyond market expectations. With further progress also made in the US and Europe, the risk that inflation remained higher for longer started to dissipate.

As the quarter wore on, and more of this supportive data came in, the tough rhetoric from Central Bankers around keeping interest rates higher for longer started to shift. In a short space of time, they went from “we might need to keep going” to “let’s hold here and wait and see”. In the US, the Federal Reserve even indicated they would look to reduce interest rates three times in 2024, something that would certainly help the US economy if delivered. Overall, we moved from slowly falling inflation and stubborn policymakers to quickly falling inflation and supportive policymakers, all in three months.

Investment markets reacted positively, with both equities and bonds performing strongly. Starting with the former, all major markets rallied during the quarter, with the FTSE 100 and MSCI World indices for example up 2.3% and 6.7% respectively.

Bond markets performed even better as interest rate risks receded. Yields fell across the board, with the 10-year UK Government Bond yield for example falling from 4.55% to 3.54% in three months. The DB Wood fixed income bucket added 7.7% on the quarter, one of its best on record.

Overall, it was a good quarter for markets, especially in fixed income (bonds), driven by a reduction in inflation and interest rate risks. It was a quarter that markets were desperately in need of, and whilst we were always confident we would get the right outcome, we had to wait a little longer than we would have liked!

Portfolio Review

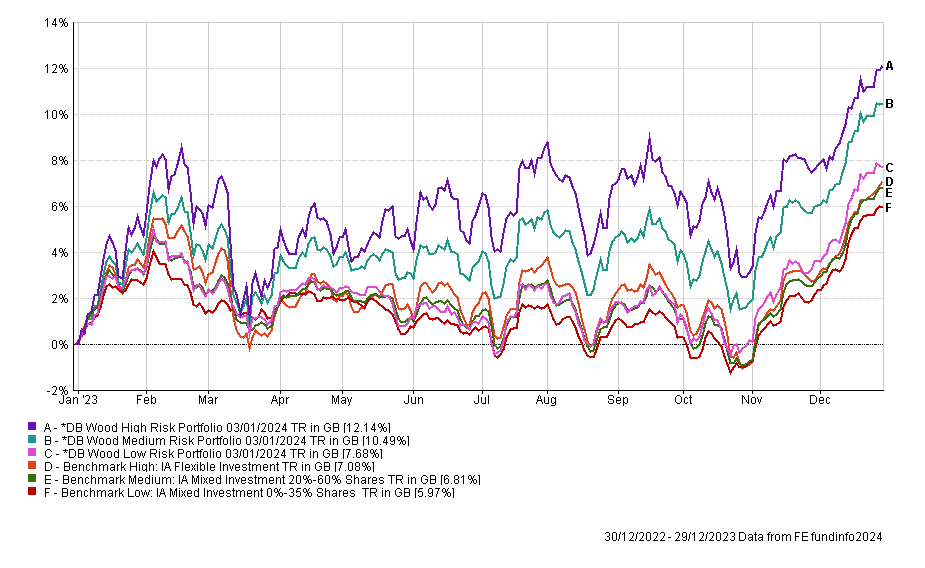

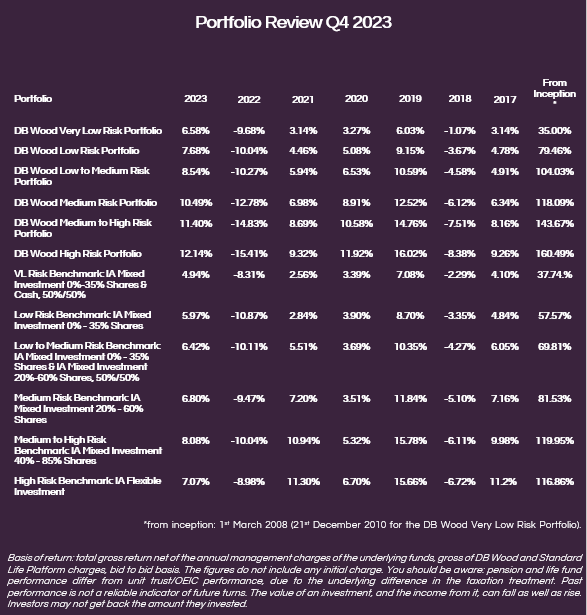

The portfolio range returned between 5.14% and 6.76% in the fourth quarter, taking the 2023 returns to between 6.58% (Very Low Risk) and 12.14% (High Risk).

Thinking back 12 months, our main reason for optimism was the income returns we could now access through a basket of high-quality fixed income and equities. It was something we hadn’t seen for 10 years, and with interest rates having already gone up 9 times, it felt like the worst was behind us. Our early additions to our fixed income positions were just that, early! As inflation hung around and interest rates kept moving higher (ultimately being hiked another 5 times) those additions detracted from performance and made it difficult for the portfolios to gain traction.

That said, as markets became more and more concerned that things weren’t improving, our conviction that we were close to the peak for interest rates and inflation fears increased further. This was aided by the fact that at the worst point for markets, we were able to add to high quality bonds with yields close to 9% per annum, adding to a longer-term return potential.

Ultimately, we started to see the benefits of our work and patience in Q4, perhaps 3-6 months later than we thought it would, though the degree of the gains was also magnified and the portfolios benefited greatly.

It would also be remiss not to touch on our higher risk portfolios, which have had a strong year of returns without the same level of fixed income benefit. Here the main attribution has come from our equity picks, which in some cases have performed 10-20% above their respective benchmarks.

Pulling that all together and although it was tough going for 9 months, the portfolios delivered good numbers in 2023. Comparative to our peers and our benchmarks we have outperformed significantly, which we hope is testimony to the hard work that goes into finding the opportunities when times are tough. Our outperformance across the portfolio range has averaged 3.5% over the year.

Global Market Outlook

With such strong returns coming through in a short space of time, the right question to ask is “what’s next?”

When we plan our portfolio allocations, we always try to think of them in multiple scenarios. We don’t want to win big if we are right and lose big if we are wrong, we try to maximise the chance we do well in the vast majority of cases. Obviously, there are times when the world is in freefall, and we can’t produce something from nothing, though those are the times we aim to add value to the portfolio from which we can benefit over the years ahead.

The investment environment is inherently less risky now than it was 12 months ago. In the majority of scenarios, the path for both inflation and interest rates is down, which is a huge positive for confidence in markets.

If everything goes well (which is not a given), economic growth will remain ok and not recessionary. Inflation will get back to 2% by the summer and Central Banks will start to reduce interest rates in an orderly fashion. Given solid wage growth, an easing in inflation pressures, and even mortgage rates which are now more manageable at 4-5% (rather than 5.5-6.5%), consumers could well be fine and by this time next year economies could be recovering. This remains our base case and would be very positive for forward investment returns.

There are always risks though, and 2024 has a number. Deviations from the above would have differing outcomes. At the extreme end a deep recession can’t be excluded from the realms of possibility, and they are inherently hard to predict in the best of times. We also have a big election in the US this year, where the policies of the main candidates are a long way apart. That in itself could solve or escalate the wars we are still in the middle of, which would have a big bearing on sentiment.

There are others as well, but although we shouldn’t underestimate those risks, the probabilities of them occurring now compared to 12 months ago are less. The key point here is that with inflation now largely under control, policymakers have some wriggle room, and can support markets and economies should they need to. This was not an option this time last year.

At the same time, although those 9% fixed income yields are largely a thing of the past, 6-7% from high quality bonds is still easily accessible. When put together with our other allocations the income underpin across the portfolio range remains between 4% and 6.5% per annum, so if nothing happens and markets finish the year exactly where they started, they are the returns that will be generated.

We therefore enter 2024 with good income streams within the portfolio range, and a more stable inflationary backdrop than we had 12 months ago. The portfolios are therefore close to fully invested across equities, bonds and alternatives, with a small cash buffer in place to allow us to take advantage of further volatility. We will of course continue to shift allocations as our views of the outlook change, with the ultimate aim of building on the 2023 results across the months and years ahead. Returns will not come a straight line, and patience will doubtless be required, though I am sure you are reassured to know, that we remain as alive to the opportunities and the threats as always.

Categories

Recently Written

Join our mailing list