Alex Chappell

4th November, 2022

Blog, IC Insights

October Performance Review

Bear (down) markets are a frustrating but necessary part of investing. The whole premise of risk taking is that it is generally rewarded, which means that equity markets should move up over time. Statistically that’s the case in 7 out of every 10 years, with the other three characterised by some form of shock – a recession or interest rate cycle two poignant examples.

This bear market started around the turn of the year, which makes it 9 months in length, and has encompassed equity market falls of 20-35%. By historical standards that makes it already an average bear market in terms of both length and size. There are those that have lasted longer, or included bigger falls, but they have typically been because of a bigger shock, such as the financial crisis in 2007-08.

So, this year’s difficult markets are about average as far as history goes, and we would say that’s reflective of a substantial but not critical shock. To build on that last point, although the conflict in Ukraine and the inflation/interest rate spikes have caused valuation adjustments and will potentially lead towards a global recession next year, there are no other ‘known’ factors that we think will lead to a further downturn from here.

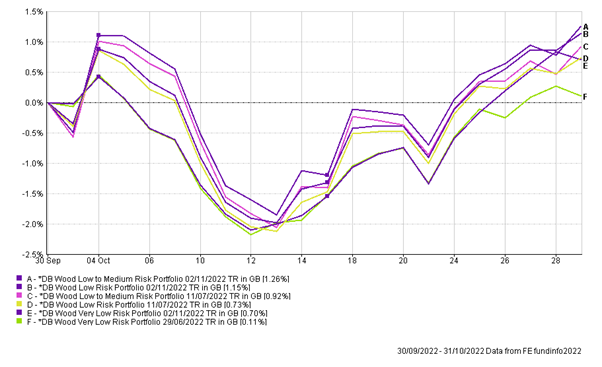

October’s market activity kind of reflected that view as well. We saw higher inflation numbers once again in the UK, Europe and US, and a variety of interest rate increases (just in the last hour as I write this the Bank of England have moved interest rates up as expected to 3%). Despite the data, both bond and equity markets have stayed reasonably firm. To illustrate, our portfolios rallied between 0.7% and 1.34% on the month depending on the risk profile selected, on the back of a continuation of poor data.

The message here is not that things can’t go lower, but that in our view most of the bad news is already factored in. Add that to the income yield you are now receiving by remaining invested (5%+), as we talked about in our last blog, and you have a much healthier foundation for future returns.

The other thing we wanted to talk about in this monthly review was the U-turn in UK government policy since Liz Truss’ resignation and Rishi Sunak’s appointment. Nearly all of the policies announced in the mini-budget in September have already been reversed, and a date of 17th November set for the new budget which looks set to bring about a much more ‘conservative’ policy stance.

From a market’s perspective, those changes have done a lot to calm global fears. UK government bond yields have fallen back and the pound settled a large way above the $1.03 we saw in September. In that respect it’s also worth noting that we had used the September period of volatility to take advantage of some extremely attractive opportunities in UK bonds. The benefits in just the last month are shown below, highlighting our three lowest risk portfolios where the bond allocations are larger (purple = actual result for each portfolio, other colours = had we not made any changes in the month):

Overall, whilst the media continues to pile on the negative news flow, not much actually changed in the global economic environment in October that we weren’t expecting, in fact markets looked more at ease with the current challenges. The portfolios had a positive month, which in part was due to the level of downside now priced in and in part due to the excellent value we believe we have in the portfolio. We can’t control when the bear market ends and the next bull one starts, but our hunch is it isn’t that far away, and in any case, we will remain active to keep adding value wherever possible.

Categories

Recently Written

Join our mailing list