DB Wood Team

2nd July, 2019

DB News

Investment Review Quarter 2 2019

Market Review

After a strong rebound in quarter one, investors entered Q2 in a more positive mood. Things hadn’t turned out to be as bad as everyone was expecting late last year, but there were still some risks on the horizon. Most notably, there was still no trade agreement between China and the US, European data was poor at best, and to leave the best to last, the Brexit can had been kicked down the road for the second time.

On the surface then, given that none of these risks were solved in Q2, it is probably a little surprising that investment markets have enjoyed another positive three months. Indeed, in sterling terms, the FTSE 100 and MSCI World (indices reflecting UK and Global equity markets) have rallied 3.3% and 6.5% respectively. However, there was one major change in the second three months of the year; Central Banks started supporting again.

When we were sat in September just 9 months ago, we were debating why investors expected the US Central Bank to raise interest rates another four times in 2019. Fast forward and expectations are now that they will cut rates three times this year. This is an unprecedented U-turn in policy. Investors like lower interest rates because they loosen financial conditions, make saving less attractive, therefore pushing people to invest. And it hasn’t been just a US centric phenomenon; policymakers in Europe, Japan and Australia have followed suit in pledging their support. All in all, this has been a key factor supporting equity and bond markets.

As far as the economics goes, things remain pretty subdued. Global manufacturing data is definitely pointing to a slowdown, although at this point it is hard to decipher how much of the weakness is due to trade tensions which could quickly reverse should there be a deal between China and the US. Consumers on the other hand are doing ok. Wage growth in both the UK and the US is outstripping inflation, which remains subdued, and unemployment is near all-time lows. Growth is therefore “not too hot and not too cold”; a nice environment for markets if history is to be believed.

Here in the UK, politics continues to dominate the headlines. By pushing Brexit back for the second time on 12th April, we now won’t have any clarity until at October at the earliest. Frustratingly the UK economy looks ready to accelerate; the government has room to spend and businesses just want clarity. Unsurprisingly though, data has painted a pretty uninspiring picture of late.

So to summarise, markets pushed higher against a still uncertain backdrop. Central bankers were the main propagators, with their more positive policy stance compensating for any economic weakness. That sets us up for a challenging second half of the year. There is certainly the potential for things to be positive, but we will need more than interest rate policy to get there.

Portfolio Review

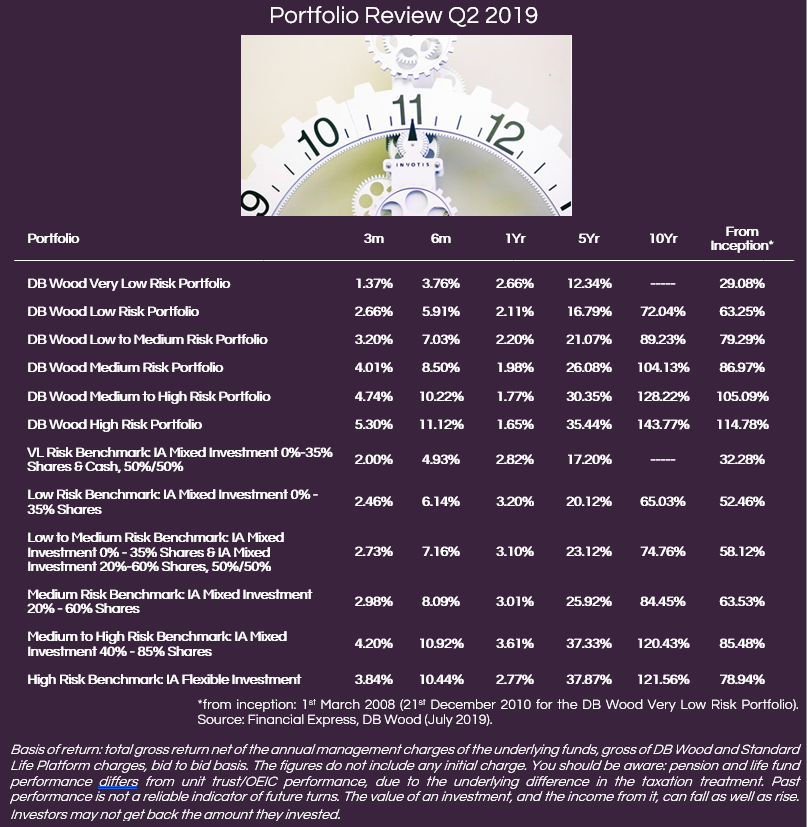

The portfolio range returned between 1.24% (Very Low Risk) and 4.83% (High Risk) over the second quarter, taking the year-to-date returns to between 3.76% and 11.12%, depending on the risk profile selected.

In absolute terms it was therefore another strong quarter, with contributions from all areas of the portfolios helping the final result. Our equity bucket was key, given the further move higher in equity markets, but we were pleased to see positive outcomes from fixed income, alternatives and property as well. Moreover, despite being composed very differently from benchmarks, it was also pleasing to see significant outperformance on the quarter, with the average added value sitting at 0.48% in just three months.

There are typically two key sources of outperformance; asset allocation (where to place assets) and fund selection (who to place them with). Over the longer term it is the former that usually drives most of the added-value, but in recent months our greatest strength has been the latter. As an example, within our equity bucket, 11 out of the 14 active funds selected have outperformed their respective indices; some by quite a margin. In addition, we have also now integrated some unique alternative ideas, such as specific allocations to infrastructure and healthcare based property, which have started to benefit clients. But again, the breadth of contribution is more pleasing to us than the overall result, suggesting that the portfolios are in a great place to continue to outperform as the year rolls on.

However, as is always the case, there were still things that could have been better. For one, whilst we achieved a strong positive contribution from our fixed interest allocations, there were certain areas we had not allocated to that benefited as Central Banks altered their stance. Moreover, Property remains a drag, returning around 1% year-to-date in aggregate, which is poor relative to other asset classes. In the latter case we are not concerned, as we are confident the asset class will continue to give us a return of around 3-4% per annum, with added diversification to help balance the portfolios.

Finally, in our Q1 review we talked at length about the benefits of the decisions we made late last year. At the time, markets were falling and others were fearful of a recession. Our analysis suggested that was highly unlikely, so we took the decision to go against the grain and increase risk as things became cheaper. The benefits of such action continued throughout Q2, as equity markets moved higher once again. This really illustrates the advantages of an active and flexible mandate, and we hope reassures clients that we are often working hardest throughout the challenging times, setting the foundations for longer term success.

Market Outlook

If history is a guide, the combination of solid growth and supportive policy is a good environment for risky assets. Left alone then, we would be optimistic about the outlook for returns from here. However, there are a number of stars that still need to align for this forecast to become a reality, none bigger than the trade outlook.

It took until the last two days of the quarter for President Trump and President Xi to de-escalate the trade tensions. Up until that point things were looking very unclear, with potential tariff increases on Chinese goods and an ongoing tech battle over Huawei. In a similar vein to Brexit, it is the uncertainty that hurts the most, with companies having to hold off investment spending or spend time thinking about contingencies. Now that they have at least agreed to re-enter talks, a little pressure will be released, but we are still some way from a full deal.

So while it looks like the tensions between the US & China have dampened for the time being, we must remain diligent. The US do not want to lose their throne as the world’s biggest superpower and will no doubt do what they can (within reason) to prevent China from overtaking them. At the same time China, who were the largest economy up until the turn of the late 19th century, are ready to re-take their status. We therefore expect to see tensions just migrate from one subject to another, further highlighting the need to be active in the way we manage money.

Whilst trade is by far the biggest risk on the horizon, we are also closely monitoring two other developments; tensions between the US and Iran, and the oil price. Both are intrinsically linked, and whilst we see a low level of threat at the minute, they have the potential to derail the otherwise positive outlook.

Back home, Brexit uncertainty will continue until the later weeks of October. While Boris remains the frontrunner to be the next leader of the Conservative Party (and consequently the next Prime Minister) it doesn’t particularly matter who is elected given the parliamentary arithmetic still remains; no majority for a no-deal, no majority for a deal similar to May’s, and a European Parliament that is unwilling to change anything in the Withdrawal Agreement (the part that is actually legally binding). Therefore, we expect the uncertainty in the UK to continue beyond the October deadline and hence are underweight UK equities.

However, the outlook for Europe isn’t much better. While Brexit uncertainty will also affect Europe (albeit to a lesser degree than it will the UK), the European Central Bank has now decided to delay its plans to start increasing interest rates and now may cut interest rates in early 2020. While this is helpful for European equities in the short term, we don’t think it will translate into better economic growth and instead expect a bumble along scenario on the continent. In fact, there are stark similarities between the Europe of today and the Japan of yesterday (low growth, low inflation and below zero interest rates), a concerning long term outlook.

This may all seem a bit doom and gloom, but in a risk first, return second mandate, it is important to properly analyse where things could go wrong. As we have been all year, overall we are cautiously optimistic. We feel the baseline outlook for risky assets is good, but that the opportunities are very specific. We are positive on areas with great companies and a solid growth outlook (US and Emerging Markets), and negative where both traits aren’t in place (Europe and the UK). We also continue to favour some of the unique ideas that aren’t correlated to the likes of trade, or Donald Trump’s tweets, such as healthcare property which is based on demographic trends, and infrastructure which we are in dire need of globally.

We are extremely confident that we are excellently positioned for the environment ahead, but as you would always expect, continue to be vigilant and active; values we believe are crucial to a successful investment journey.

Categories

Recently Written

Join our mailing list