The Investment Committee

8th May, 2020

Blog, IC Insights

A Healthy Split…

We encounter behavioural biases many times within our daily routine. Under the current circumstances for example, “confirmation bias” is very prevalent, which represents the tendency to search and favour information that supports our own beliefs. Most of us are likely to place more weight on an article that suggests lockdown could be ended relatively soon, over one that proclaims it could go on for many months. Either could be right, but the more positive outlook is easier to hear, and makes us feel better, so we prefer it.

In terms of personal financial planning, most of us will be familiar with mapping our money in our minds; known as “mental accounting”. It refers to the idea that people prefer to segregate their money and assign it to different things. We prefer to have two accounts; one for the shorter term needs and one for longer term. Without this, when panic sets in, behavioural biases push us to sell investments out of fear, and we normally do so irrespective of what purpose and how long that money is there for. As the rational investor knows from previous evidence, this is nearly always a mistake.

Using the same concept then, it can be helpful to think of portfolios in that way; two separate accounts rather than one. Whichever portfolio you are invested in, it can be split into a defensive bucket and a growth bucket. A low risk portfolio will have around 75% in defensive assets, and 25% in growth assets, whereas a medium-to-high risk portfolio will have 25% in defensive assets, and 75% in growth assets. The defensive portion is pretty boring – it isn’t there to do much other than eek out steady returns and not fall much when markets fall a lot – we call this “short term money”. The growth assets in contrast move around a lot, but over the long term deliver excellent returns – we call this “long term money”. Another way to think of it is that your “short term money” should cover your next ten years’ income or expenditure requirements and your “long term money” should cater for, well, for your longer term needs.

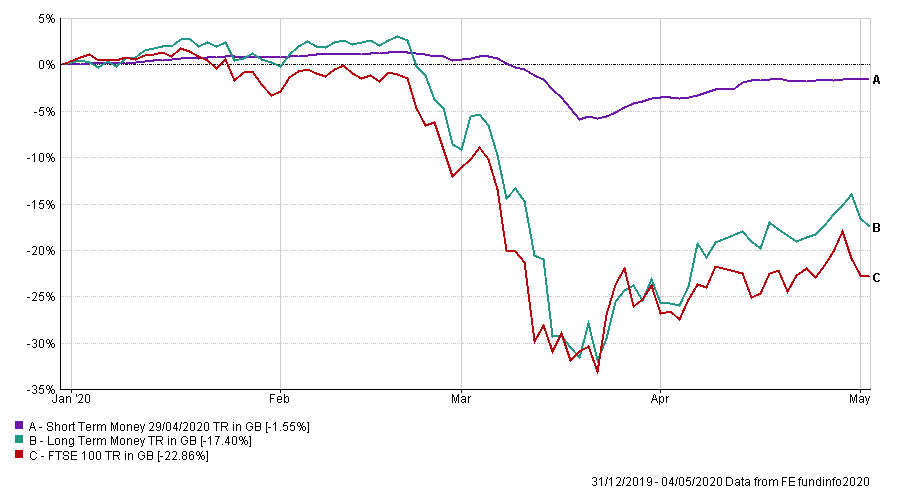

The chart below shows how these two accounts have performed since the start of 2020. Importantly, despite one of the most challenging market environments in history, the short term account has protected well, and is only down 1.5% in 2020, compared to the wider UK equity market at -23%. The long term account in contrast is down to a much greater extent, but has still managed to outperform the equity index by around 5% over just four months. Low risk investors should therefore rest assured that 75% of their portfolio is pretty much in the same place it started the year at (and therefore their next 10 years of income remains secure), and high risk investors should be pleased to see that they are in a great position for when things ultimately improve.

Another important point to emphasise is that both the level of protection, and the forward returns in both those lines have improved. The large scale action by Central Banks across the globe has vastly improved the conditions in bond markets, which make up the greatest portion of the short term bucket. Moreover, whilst in January that account was offering an income return of around 2%, it is now offering more than 5%. As far as the long term bucket is concerned, equities at the start of the year were expensive, whereas now there are some excellent businesses trading cheaply.

As we wrote last week, the outlook remains uncertain in our view. There are several ways the next few months could play out, and confirmation bias is one of the challenges we need to guard against, ensuring we respect both the positive and negative possibilities. Irrespective though, the splitting of your portfolio into defensive/short-term and growth/long-term buckets, can be helpful in providing reassurance. Both accounts we believe are well positioned and we remain focussed on the risks and opportunities as they continue to evolve.

Categories

Recently Written

Join our mailing list