Ashley Brooks

12th January, 2016

IC Insights

Investment Review Quarter 4 2015

Market Review of Quarter 4

The final three months of the year saw improved returns within most investment markets, although in summary 2015 was a disappointing year across bond and equity markets generally. In many ways, the year can be characterised as a false start. Fantastic pre-April growth was followed by eight months of volatility spikes.

Investment markets do not like uncertainty. 2015 brought much noise around interest rates hikes, when and where they may happen, were they too soon or too late, and how fast would they rise? The oil price fall gathered momentum, geopolitical tensions didn’t help ease sentiment, and the Chinese economy was under the microscope. It is always important to push the noise to one side and

concentrate on fundamentals. The reality is that the global economy took some important steps in 2015. For one, the Federal Reserve initiated their interest rate tightening cycle on 16th December, meaning that US money and credit markets will be on the path to normalisation after more than seven years of abnormality. Chinese policymakers seem to have taken strides in the right direction to ensure their over leveraged property market and disproportionate growth becomes more sustainable. This is vital as they make the transition from a developing to a developed economy.

To touch on the volatility caused by Chinese markets in more detail, our view is that these are not in any way related to the underlying fundamentals of the Chinese economy. The Shanghai and Shenzhen markets have caused all the headlines, however, the majority of investors in this market are Chinese retail investors who are behaviourally and emotionally driven. This weakness may have something to do with the 119% increase these markets saw in 2014… but no one was batting an eyelid then!

Let’s be quite clear, the Chinese economy is not hitting a wall. It is slowing down, not melting down. Annual growth has slowed from 7% to nearer 6%, but everyone has forgotten that it’s the quality of growth that’s more important than the quantity. Retail sales grew 11% last year, the services sector looks strong and travel data is up. It is true that the manufacturing sector is lagging, but the same can be said for the US alongside other developed countries. The weaker currency, which is also not as bad as headlines would have you believe, should help stimulate the economy over the medium term. All-encompassing, the economy seems to be making the transition to a more sustainable, consumer based model, and it is the bubble that retail investors fuelled last year that is coming back to haunt them.

In these times, it is vital that we remember why we invest, and step back to take a longer term view. Across living history, markets have experienced good and bad years, and the future will be no different. Ultimately though, it is the price you pay for an investment, and the price you sell it for, which determines your success. Stay calm, don’t listen to noise, and remain invested. Incidentally, our portfolios performed very well against this backdrop.

Portfolio Review

All our risk-rated portfolios finished 2015 ahead of all of their benchmarks. Despite equity and bond markets producing negative returns on the year, we achieved positive returns across the board, albeit lower than our long term returns expectations.

The latter is not because we have underachieved this year. Conversely, it has been one of our strongest years in terms of relative performance (in comparison to benchmarks and market indices). But of course, we are not immune to falls in investment markets, and instead try our hardest to mitigate them. The UK equity market fell 9.6% between 24th April and 31st December, and in contrast our Low, Medium and High portfolios returned 0.51%, 0.12% and -0.54% respectively (FE Analytics, January 2016).

Our cautious stance has in fact been warranted for 24 months now, where we have focussed on diversifying sources of return and risk factors, to try and generate sustainability for our investors. Increasing our property exposure in 2014 and 2015 has continued to pay off, as this has been the strongest performing asset class on a risk-adjusted basis. We have kept a low weighting in bond markets, where we see the largest valuation risks, and have had a preference over equity managers who are defensive. Overall though, it has been the blend of assets that has been our greatest strength this year.

The key to portfolio management is to hold onto as much of your value as you can when investment markets are falling, and use your stability to buy into assets that have been oversold and look like an opportunity. On the upside, follow the value curve and sell when appropriate but only if assets can be replaced by better value elsewhere. We asses our success by applying ratios to our performance, and upon this assessment we can see that all of our portfolios provided clients with less volatility than the average portfolio in the same risk benchmark, whilst also providing a greater return per unit of risk taken. If we continue to drive through with delivering this key mandate, then our client returns will continue to achieve their longer term objectives. You will note that all our risk rated portfolio returns over three years and five years, as well as from inception have delivered above average returns, and most importantly the return targets that we set to achieve our wider client objectives.

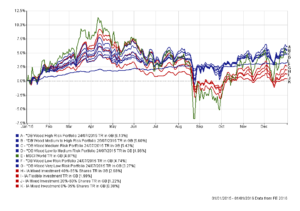

The right hand chart displays the performance of the portfolios over 2015. Whilst it is quite busy, you will see our portfolios are highlighted in blue, their benchmarks in red, and the MSCI world in green. The equivalent returns data is displayed below the chart. For your information, our Very Low and Low Risk Portfolios are benchmarked against the IA Mixed Investment 0% – 35% Shares, the Low to Medium and Medium against the 20% – 60% Shares, the Medium to High against the 40% – 85% Shares and the High against the Flexible benchmark.

Market Outlook

We have now entered the Chinese year of the Fire Dragon, which if this lives up to its description should be promising. Judging by the start we have made, 2016 looks set to be another challenging year though. It does look a little like 2015, though this time around we are happier that the economic recovery is more likely to be sustainable moving forward, particularly in the US and Europe. There are however, numerous aspects to consider, not least the background in the developed world of low interest rates, low inflation and low economic growth. Add into that mix lower commodity prices and countries at different stages of the monetary cycle (including the US and Europe); some monetary tightening and some easing policy, which in turn affects the value of currencies; and you have a demanding environment.

Closer to home, the latest Deloitte survey of UK Chief Financial Officers (CFOs), outlines that confidence at the end of 2015 is around 50% of what it was at the peak in mid-2014. CFOs are less likely to take risks onto their balance sheets, and are increasingly defensive in nature, looking at reducing costs and cutting capital expenditure. Most of this concern centres around the EU referendum, which is very much on our volatility radar.

All of our portfolios are very heavily diversified, to ensure we protect our clients’ wealth against sharp falls in investment markets, and remain cautiously positioned relative to their respective benchmarks. We do however expect to find opportunities to add value through our asset allocation model as markets move, particularly via the increasingly obvious two themed world economy; reducing commodity and energy prices which should logically drive stronger household consumption and business services, contrasting with weaker industrial production and global trade.

We continue to see investment market volatility as a chance to add value and growth over the medium term. We remain confident that our preference for equities is the correct strategy, though this is very much at the long end of our view. In 2016 we are expecting continued volatility, but believe European equities, selective UK and US equities, as well as Japanese equities offer opportunity.

The good news is that there are signs of global economic strength in a number of areas. Employment is still rising (in the UK there are nearly two vacancies for every job seeker), and wage growth is starting to come through. This should support consumer based economies where lower commodity and energy prices are supportive to business and households.

Key variables to watch are economic growth, particularly in the US, UK, Eurozone and China, as well as inflation rates including wage inflation, and currency valuations.

How the Chinese manage their economy in terms of the stimulus they apply will also be crucial, as this will have a big impact on asset prices globally. The Chinese stock market is not well understood. The huge gains and recent losses in this market should not be linked to the Chinese economy which continues to slow at a sensible pace. Reducing growth in their economy is expected as the Chinese authorities try to rotate from an industrial bias to an increased influence from the consumer. From a macro perspective we feel that China is operating within expectations, and therefore wider global reaction is well overdone and adds to our scope for opportunity.

Moreover, we are at that stage in the investment cycle where we look to obtain value through opportunity. This is always a crucial stage in growing our clients’ wealth, as buying at lower prices can be highly rewarding over the longer term.

Investment Committee

*You should be aware that pension and life fund performance differs from unit trust/OEIC performance, due to the underlying tax treatment. Past performance is not a reliable indicator of future returns. The value of any investment can go up and down, and investors may get back less than they invested.*

Categories

Recently Written

Join our mailing list