DB Wood Team

7th July, 2022

IC Insights

Q2 2022 Investment Review

Market Review – Q2 2022

Whilst our general outlook since Q1 has remained positive, the outbreak of the war meant the second quarter was always going to be difficult, simply increasing the pressures to the downside on global growth (as well as the obvious humanitarian effects). Consequently, the big worries of the first three months of the year, namely inflation and interest rates, were unlikely to collapse in such a short space of time, so we expected things to remain tricky in the short term. That played out, with inflation staying higher primarily due to rising energy costs, and economies weakening as consumers started to reign in consumption.

To start on inflation, which is by far and away the most important variable to markets over the next twelve months, prices have continued to rise at an unsustainable rate, with annual numbers somewhere between 8% and 9% across the US, UK and Europe. Here at home nearly half of that 8% can be attributed to energy prices, though food and other components have also trended upwards in price.

The word “recession” has been googled 10x more than it was in Q1, and as we argue in our outlook, there is a real chance that we do get one (might not be a bad thing though) with various data points from consumption to manufacturing suggesting a sharp economic slowdown. Technically a recession is defined as two negative quarters of GDP, and with the US posting a -1.6% GDP figure for Q1 and record low consumer confidence following in Q2 (even lower than during Covid), we may not have seen the end of that interest yet.

So, our challenge this year has been a cocktail of high inflation and falling growth, not to mention ongoing tensions in Ukraine. The result was further weakness across equity markets, with the MSCI World and FTSE 100 as examples, down 9% and 4% respectively across the quarter. To put it in perspective, 2022 ranks as the fourth worst start to a year in history, with 1932, 1962 and 1970 the only three to see worse returns to this point in the year.

It is worth also touching on commodities, which have been one of the only bright spots so far in 2022. They tend to perform best in environments of high inflation and strong growth, but less well when growth slows as people consume less of everything. As investors have shifted their attention towards recession risk in recent months, prices have fallen sharply. In June alone, the Bloomberg Commodities Index was down 10% – something that could be key to inflation changes in the months ahead.

Finally to touch on bond markets, we have pleasingly seen some stabilisation after a difficult first 5 months. UK Government Bonds are still down 13% year-to-date, representing the single worst start to a year for bond markets in history, though with bonds tending to perform well when growth slows, we have seen returns start to pick up in recent weeks.

In general then, it was an expectedly tough quarter. Economies are clearly slowing and will soon be flirting with a recession, and that has started to change the dynamics of markets with bond returns improving, commodities falling and equities awaiting further news. What really matters now is what that does to inflation, and in that respect as we will argue in our outlook there are good reasons to be positive despite this year’s market challenges.

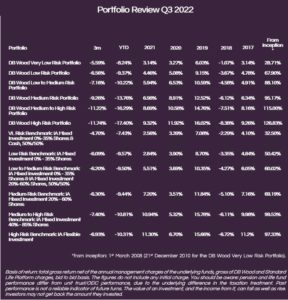

Portfolio Review – Q2 2022

We often say that we work hardest for clients in the tough times, or put another way, we are most active when markets are falling. The whole premise of investing is to buy when things are cheaper, and sell when they are more expensive, and to implement that in practice you need to make more changes in difficult markets. From our market review, you might be thinking that if we knew it was going to be tough, why didn’t we do something more robust to reduce the downside? The reality is that the only place to hide has been cash, and the problem with cash is the timing of selling out and buying in. If clients are investing for the medium term, its always best to reallocate to sensible opportunities whilst staying invested. This can prove painful in the short term, though it is a more profitable process than trying to find the bottom of markets.

Indeed, some of the most impactful decisions made during the Covid crash in 2020 were those where we added to areas of opportunity when the market fell. The same principles apply now, and we have been busy across the last quarter in particular trying to make the most of the opportunities markets have presented.

Examples include quality business’ like Microsoft or Amazon, which are 40% cheaper than they were at the start of the year. If we do head into a recession, even if we all reign in spending, you want to own ‘quality’ businesses with strong balance sheets and the ability to continue to gain market share. We have added to a number of equity holdings as markets have got cheaper.

Similarly bonds now represent much better value given rising income yields. We have moved from getting 1-2% income from bonds, with little prospect for capital growth, to 4-5% income with a significant chance of capital growth. Not only will they do well when inflation falls (into late 2022 and into 2023, interest rate expectations will also fall) but they will perform well in a recession, so provide upside in two environments.

Whilst we are very confident those decisions will add material value to portfolios over the longer term, one of the challenges of being so active when things are difficult is increased short-term volatility. Given that we have been progressively adding to areas of good value across recent months this has left the portfolios marginally more exposed to the market volatility.

The portfolios enter the second half of the year with as many great ideas as we have ever had, with a core of good quality equity and bonds that should perform well in both difficult economic environments and when things improve. In that respect we are optimistic that this time next year we will be looking back on a much more positive picture, with the decisions that provide those returns being made over the last quarter.

Market Outlook

Our base case is that most developed economies head into a mild recession across the coming quarters, and that inflation falls quickly in Q4 and 2023. In that environment we see both equities and bonds performing well, with forward returns now expected to be extremely attractive on a 3-5 year view.

The word recession is quite scary – we think of the great financial crisis in 2008, or even the great health crisis in 2020 – though there are times, providing it isn’t too deep, where it can be a good thing. One of those times is when inflation is high, as too many buyers are chasing too few sellers. You can either sort that out by increasing supply, though when the main issue is energy and there is a war at stake, that is hard. The other, which is the path that policymakers have chosen through harsh rhetoric and quick interest rate hikes, is the reduce demand. A mild recession then, is what we are now expecting… just enough to cool inflation but not too much that unemployment rises significantly.

Once policymakers see inflation coming down, they will then pivot to a more accommodative stance to get the economy back up and running. We therefore see material upside in equities into the end of this year and 2023, even if the short-term news flow across the summer could be difficult.

Whilst we have added risk to the portfolios across the board, we have done so in assets that we expect to perform well as growth worsens. Moreover, you now have a number of things working in your favour rather than against you. Income returns have improved markedly, so even if this time next year capital values are at exactly the same cheap levels, 2-4% is now coming in in income. Further, the significant correction we have already had means a lot of the bad news is priced in, leaving the chance of a negative surprise much lower than it was earlier this year when expectations were for a rosy 2022.

Within equities we remain slightly overweight the US market, and overweight ‘quality’ businesses. We are cautious on Europe given the political environment, as well as the UK where inflation could remain stickier due to our lack of energy independence. We are now overweight fixed income, which tends to perform well both in a recession and when inflation falls and have also added to infrastructure and clean energy exposures which should continue to benefit from structural investment.

It really does feel like the portfolios are full of excellent long term ideas, and that it is a matter of time until that starts to play out and translate into returns. Patience once again, is the key message, and not to be too concerned if the short term noise around a recession increases. The key to unlock future returns is the inflation picture, and having already seen a large correction in commodity markets, the pieces of the puzzle are starting to fall into place.

Categories

Recently Written

Join our mailing list