The Investment Committee

4th June, 2020

Blog, IC Insights

May Portfolio Update – No Rest for the Wicked…

Hindsight is a wonderful but dangerous thing. It’s best used to constructively assess previous actions, aiming to learn lessons that can be applied to the future. Often though, it is used to manipulate a situation for one’s own interests. Questioning our high death numbers compared to other countries is of course a valid question, though implying that the numbers mean our government has completely mismanaged this process without consideration for population density variations, demographics, reporting differences etc. is not particularly well founded. Looking at the right information together with your desired outcomes can be hugely beneficial if the data is accurate and is analysed objectively! If framed incorrectly though, it can be dangerous and misleading.

Just as our financial planning team look to estimate the tax savings provided to many of our clients through excellent advice, our investment team look to assess whether the changes they have made to our portfolios have been positive or negative. One of the most objective ways of viewing this is to compare the actual journey with the changes made, versus if we had not made any changes at all. The answer at least at the point of assessment is not open to debate… it is what it is.

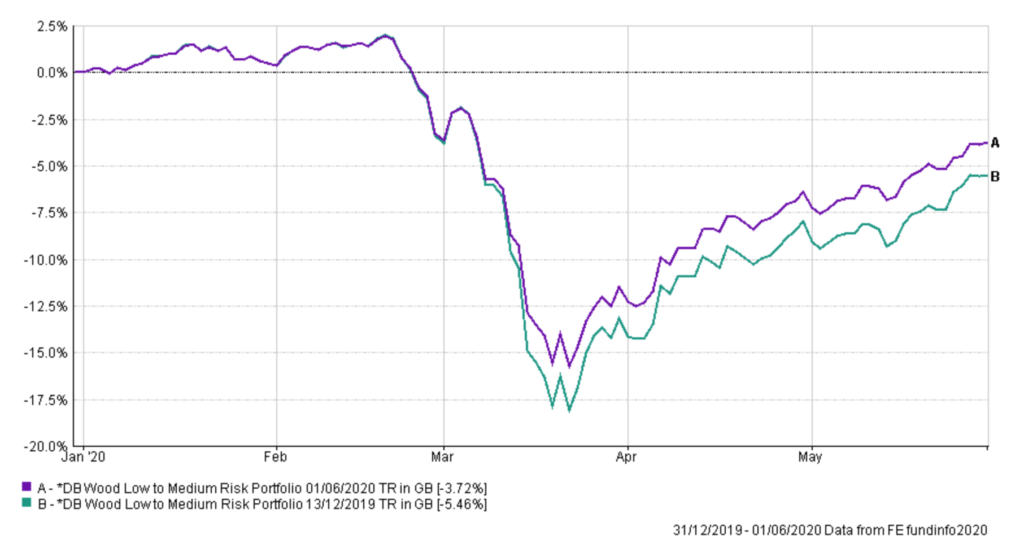

The chart below shows this comparison since the start of the year – the purple line is the actual journey clients have received for our Low to Medium Portfolio (all changes included), and the turquoise line is the journey that would have been received had we opened on 1st January and then done nothing up until now. The difference is 1.74%, a considerable benefit from the 17 changes we have made so far.

To be clear, the majority of these changes were small tweaks, though there were two key ‘risk off’ and ‘risk on’ decisions. A short summary of this activity would be our quick decision to reduce risk levels across the portfolio range when the pandemic was starting to accelerate, and then increase risk levels from mid-March onwards when we felt there was too much pessimism. We also quickly shifted out of those sectors that would be worst hit by this crisis; retail, leisure, travel etc. preferring to hold companies in sectors such as consumer staples and technology that would benefit.

The benefits so far have been notable, though we don’t profess to have got every decision right. As we wrote in last week’s blog, it would be fair to say we entered this year with too small an allocation to government bonds, which would have helped us further when markets fell. There were reasons for this decision that are still relevant; they remain far too expensive to provide much long-term value; though perhaps our focus on valuations led us to take our eye off what might better protect us in a downturn. Like everyone else, we had not predicted this event, though it has led us to review our contingency plans.

This is a constructive use of hindsight then – looking at what worked well and what could have been better and assessing where we can use that information to improve things in the future. We did protect ahead of our benchmarks on the downside, though we still feel we could have done better. On the upside, we would say that to date we are performing extremely well and have now reached a point where our portfolios are only marginally down in 2020, comparative to UK equities which remain well below their highs despite an improvement.

Our analysis of our decisions so far this year is therefore broadly very positive, though as always, there are areas we can improve. This is the same in any process and is especially apparent in times as challenging and fast-paced as the current ones. Moreover, we understand the full benefits of our activity in the first five months of this year are far from finished, and we need to remain on the ball to continue to build on that progress. Our country is very much in the same position, and it’s important to look constructively backwards, but also positively forwards.

June in this respect is looking like a crucial month, with further lockdown easing likely to occur and the first results from clinical vaccine trials due. Add into that mix a US election race that is heating up given recent events in the states, and the fact Brexit talks are resuming. There is no rest for the wicked!

It is always invaluable to listen to our clients’ questions and feedback, and as such, next week’s blog will be a dedicated “Question the Committee” edition. All we ask is you submit your questions to questions@dbwood.co.uk, which can be on anything from current affairs to performance, by Tuesday 9th June, and we will endeavour to answer them in next week’s blog.

Categories

Recently Written

Join our mailing list