DB Wood Team

27th October, 2017

IC Insights

‘Spooky Charts’ – Happy Halloween!

It’s that time of year again… children running around sporting witches hats, pumpkins with gruesome faces are lining the streets… it can only mean one thing. Halloween is upon us! In keeping with the theme of the season, we here at DB Wood have decided to mix it up in this week’s Hot Topics. We present to you examples of some of the scariest investment charts in history, teamed with commentary from eye witnesses of the events.

Now I must warn you, the content of this blog is terrifying, we’re still consoling members of the IC team who were subjected to writing it. Nothing a toffee apple can’t fix… it is Halloween after all!

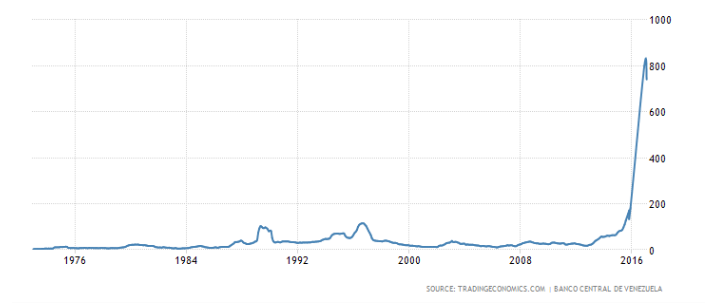

VENEZUELA INFLATION RATE

“As we worry about inflation hitting 3% here at home, we should bear in mind that the Venezuelan rate hit 800% earlier this year. Fuelled by an intense political crisis that has spiralled since 2014, Venezuelan’s have faced daily inflation of 1.85% compounded over the whole year. In real terms that means 100 Venezuelan Bolivar today will be worth 98 tomorrow, 88 next week, 58 next month and 0.12 (or12 centimos) in one years’ time…”

Alex Chappell

Investment Committee Vice-Chairman

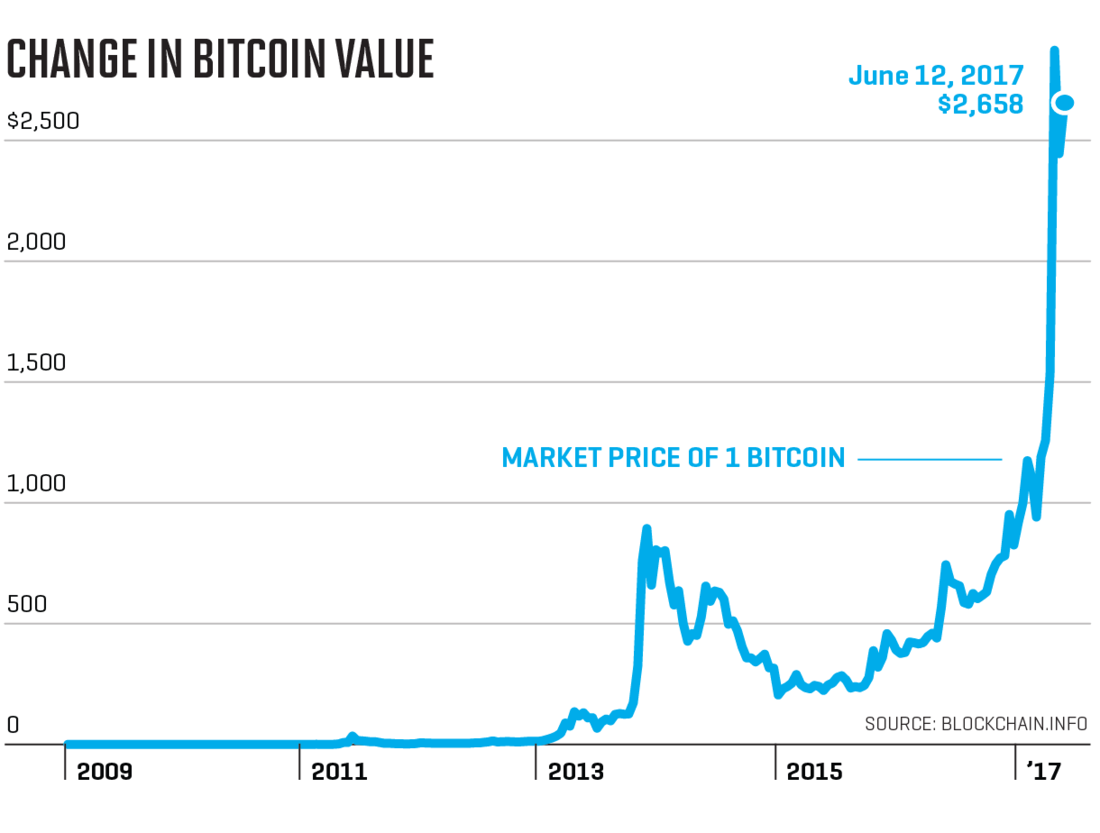

BITCOIN US$ EXCHANGE RATE

“We often find ourselves discussing ‘bubbles’ in traditional asset classes, although the case is arguably stronger for some alternatives. The sharp rise seen in the prices of some fine art and even Bitcoin (an internet based crypto-currency) over recent years is pretty scary. It’s hard to rationalise and understand how an unregulated, internet based currency can be valued… or used in the real world for that matter! The price is even heavily influenced by several Chinese cartels… think I’ll stick to those note things with HRH on the front.”

Michael Simms

Financial Planner and Investment Analyst

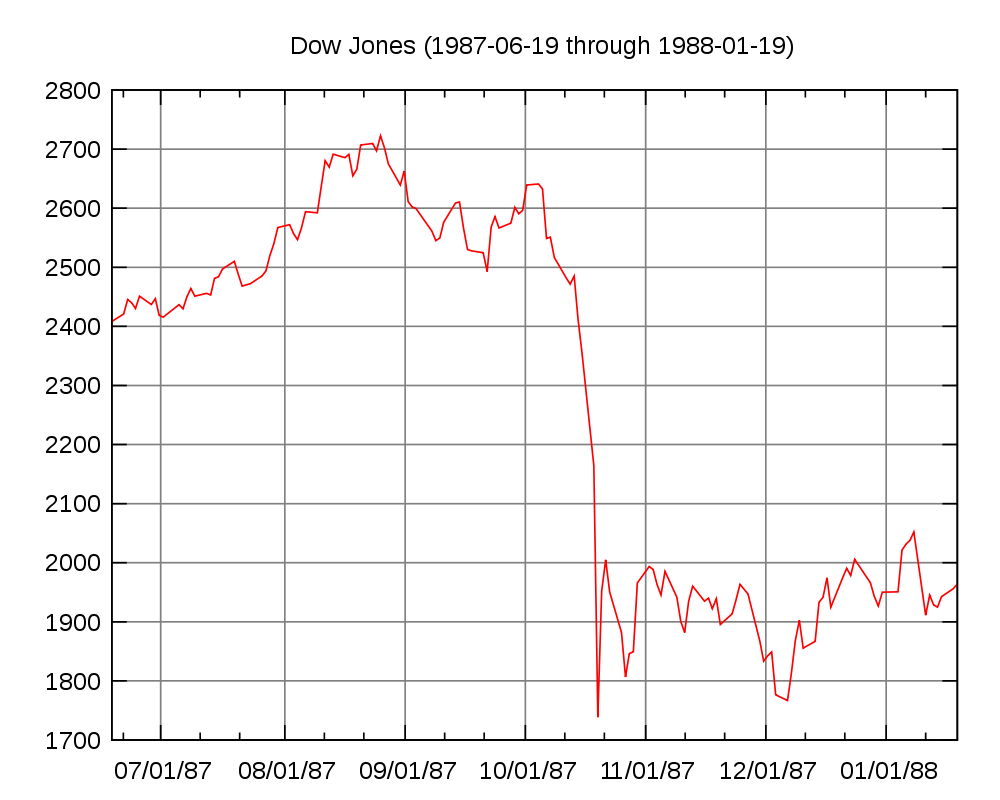

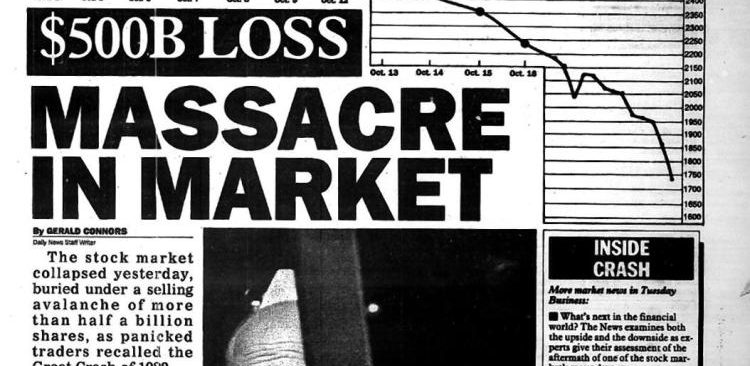

1987 BLACK MONDAY

“Believe it or not, I was managing money in 1987. I remember sitting at a client’s house in Bilsthorpe when I heard the news. I realised we needed to move his funds to cash quickly to avoid one of the largest single day corrections in history. At the time, Prudential Holborn were proud of their ability to execute quickly… it wasn’t ideal that the phone was continually engaged that day though. My opinion of the company was somewhat tarnished, and the client’s portfolio dropped more than 5% on the day. Not bad compared to the market correction of 22.6% though. Subsequently, it’s interesting to see that if someone had invested in the FTSE All-Share in January 1987 and remained there for the whole year, they would have returned 4% across the period. At some point they would have been sat looking at a loss of 37% though. Scary or what?”

Graham Hicks

Investment Analyst

2015 FLASH CRASH

“Monday 24th August 2015 – The day the Dow Jones (US Stock Market) plummeted 1000 points when it opened. The New York Stock Exchange had to pause trading on the market over 1200 times because the fall was that aggressive. Why did this happen? People believe it was due to a sudden scare when the Chinese Stock Market fell 8.5% before the US market opened. Suddenly the number of buyers in the market reduced severely, as everyone became desperate to sell their stocks. This saw some ETFs (passive investment portfolios) fall as much as 43% in the space of 45 minutes. Although most regained about half of these losses back by the end of the day it is a scary reminder that just because the market is going up doesn’t mean it will continue…”

Declan Gamble

Investment Analyst

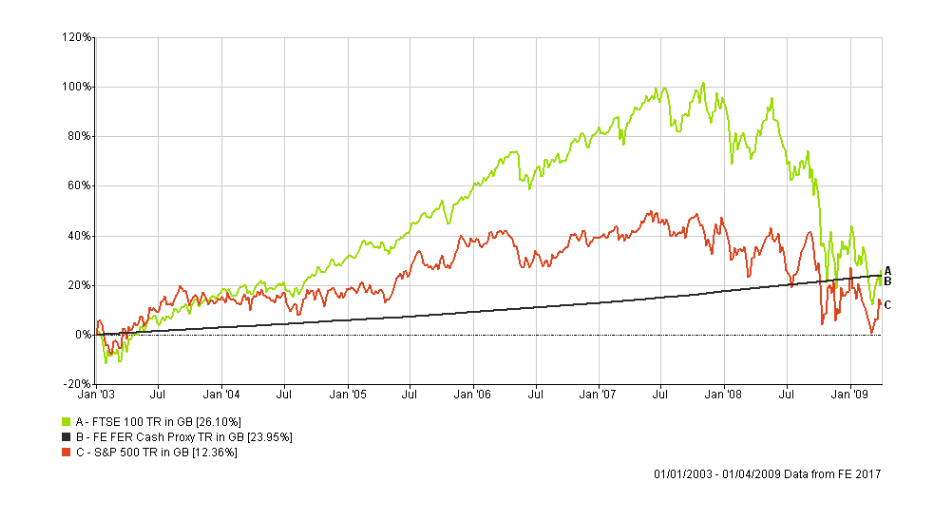

2008 FINANCIAL CRISIS

“I was at University during this financial crisis, and the mood was bleak graduating in 2009 under the backdrop of “The worst financial crisis since the Great Depression”. Then, and now, the fundamental principles remain the same both personally and within investment markets – do not make any knee-jerk reactions, always refer to your long-term objectives and initial plan. Making the correct provisions whilst times are good will ensure that you are well positioned for short term instability, and so that you can take advantage of the opportunities created long term.”

Oliver Crampton

Financial Planner

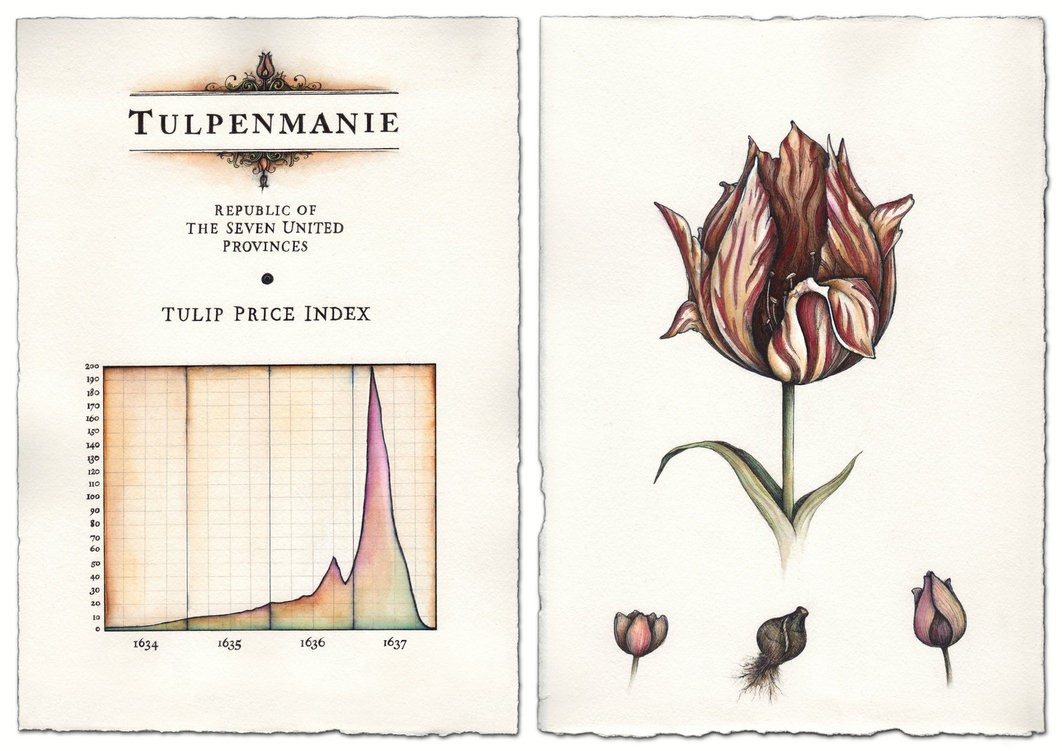

TULIPMANIA

“Arguably the greatest bubble story of all time. Back in the 1600s, the Dutch got speculation fever so badly that you could buy a house on the canal in Amsterdam for the same price as just one Tulip bulb. After already trading at a premium to normal flowers, Tulips caught a virus that caused flames of colour to appear on their petals, increasing interest further. The prices grew to reach extraordinary levels before collapsing in February 1637, wiping many people’s finances out. “

Alex Chappell

Investment Committee Vice-Chairman

Image 1) http://uk.businessinsider.com/venezuela-hyperinflation-chart-2017-4?r=US&IR=T

Image 2) http://fortune.com/2017/06/26/bitcoin-blockchain-cryptocurrency-market/

Image 3) https://commons.wikimedia.org/wiki/File:Black_Monday_Dow_Jones.svg

Image 4) https://www.terraseeds.com/blog/2015/08/us-stock-market-currencies-flash-crashed-black-monday/

Image 5) Financial Express, 2017

Image 6) https://simanion.deviantart.com/art/Tulpenmanie-350361624

Categories

Recently Written

Join our mailing list