Ashley Brooks

12th January, 2018

IC Insights

Investment Review Quarter 4 2017

Market Review of Quarter Four

A strong start, a flat middle and a buoyant finish – the three distinct phases that characterised investment markets in 2017.

The main stock markets started the year on the front foot, led by Europe and Emerging Markets. The French election result was in line with expectations, so as political risk generally reduced, attentions turned to economic growth and the prospects for inflation and company profits. The term “synchronised global recovery” was the phrase used by many economists to describe one of the few times in history that many of the major economies were all growing with momentum, and so the first half of the year saw many investment markets reach record highs.

From there, markets struggled to decipher the next directional move, uncertain about how high they could go. Would they sell off? Are growth forecasts too high? What about interest rates? As a result, markets generally moved sideways as people took some profits. This pattern continued through Q4, with investors becoming nervous about the potential for US tax reform to fall short, but once that was agreed, the Santa rally pushed us to a solid finish.

All-in-all, equity markets made good gains with the FTSE 100 returning more than 10% on the year, a pretty buoyant return by historical standards. Bond markets told a slightly different story, but still managed to give you 2%*, and UK Commercial Property had another solid year to finish up just under 7%.

Clients who need to take a high-risk approach were well compensated in 2017. For those who need to protect capital but still achieve a return above inflation; markets produced enough opportunity. In general, providing you were well diversified, objectives all round were achieved in 2017.

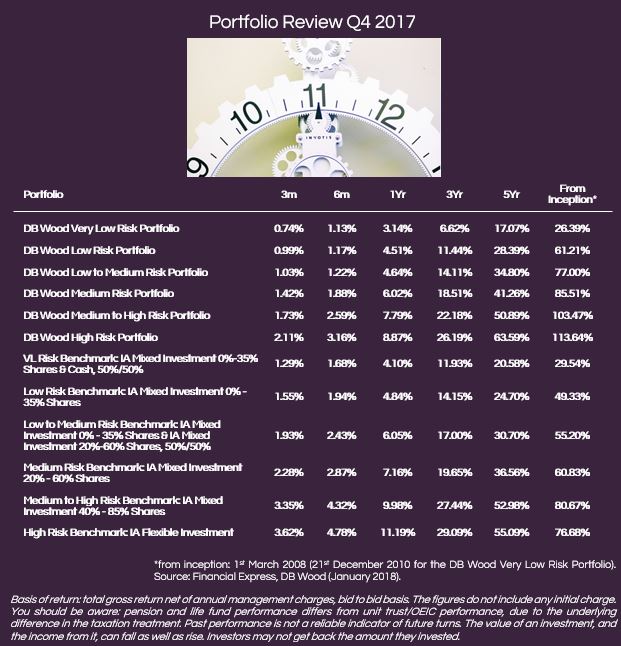

To provide some longer term context, the 10-year anniversary of the global financial crisis is upon us, and since then investment valuations have grown significantly, despite the odd wobble here and there. For example, since the 1st March 2008 (inception) our Low Risk Portfolio has produced a return of 59% and our High Risk around 110% to 31st December 2017*. The Low Risk Portfolio has achieved this whilst exposing itself to around 35% of the risk associated with the FTSE100 index**. This has not been an easy job though, especially given our philosophy to try to protect capital before we commit to ideas on how to grow it. In other words, we don’t take undue risk with your money. Importantly, when there is a significant amount of optimism, history tells us to be cautious, and we enter 2018 with investors as positive as they have been at any time in the last 10 years.

The euphoria that sits around bitcoin is just one example. If you haven’t heard of bitcoin yet, it’s a digital currency that has no real value and is subject to a lot of speculation. Despite very few people understanding it, it has returned 1000% since the turn of 2017, though a fall of 30 or 40% in a day is still relatively normal. Obviously you would expect us avoid such speculative assets within our investment mandates, but it is better used as an example of the type of risk that is still below the surface despite the good returns on top.

In summary, the figures suggest 2017 will be remembered as a good year, and indeed it has been for the global economy. Beneath though, risks continue to bubble and change form. Take Brexit, the reversal of interest rate policy in the US and the ongoing controversy around the size of Donald Trump and Kim Jong-un’s respective buttons.

As always our job is to keep you away from these risks whilst delivering a sustainable journey that you can depend on.

Portfolio Review

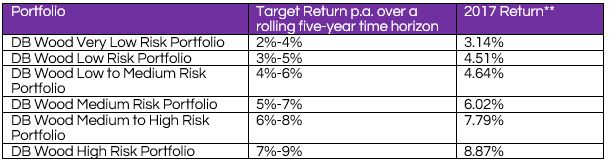

Our portfolios finished 2017 solidly, returning between 3.14% and 8.87% across the year, depending on the risk profile selected. All comfortably achieved the return targets that we set over a rolling five-year time horizon, as displayed by the table below:

The longer-term performance numbers continue to demonstrate the strengths of our active stance, through changing and unique economic scenarios. Of course, the premise of active portfolio construction is to add value whatever the environment, and since their launch we have consistently achieved this.

Perhaps more importantly though, our philosophy to diligently control risk, and not expose our clients to too much downside remains central. Over the last five years, our portfolios have operated with 23% less risk than their benchmarks on average. Further, we have avoided many of the risks that don’t show in the end numbers… needless to say we have not been investing in bitcoin or European junk bonds!

The best contributions to our returns in 2017 came from European and Emerging Market equities; positions we built through 2016 in anticipation of good gains. Our good allocation to UK Commercial Property also continued to benefit investors – it has been the best performing asset class on a risk-adjusted basis this year. Moreover, we have stayed away from the difficult areas in fixed interest e.g. US treasuries that could have lost you somewhere in the region of 7% and a very choppy UK government bond market.

Two things have held us back – less equities (less risk) than our benchmark peers, and a very difficult year for our biggest equity holding, Woodford Equity Income. With respect to the former, we will generally always hold less equities (especially in the lower risk portfolios), because equities and are trading at all-time highs. The latter invested in more demographic and value based businesses which were not well rewarded. It is important not to get too drawn into the short-term though… Neil Woodford and his team have delivered great results for our investors for many years, and our detailed due diligence continues to suggest he is well positioned to bounce back strongly over the months and years ahead. As with all our holdings, we will continue to monitor this position closely and keep you posted.

With respect to diligence and research, you may be interested to know that our Investment Committee met more than 200 fund managers in 2017, had two external audits (passed with flying colours), hired a new investment analyst in Declan Gamble and bolstered our infrastructure with a redesigned fund screening tool.

Of course, its pleasing to see the numbers reflect the hard work, but that is par for the course in our business. The past is now behind us, and we reset to push for another strong year in 2018. If equity markets continue to deliver stellar returns, we will do just fine, but if they struggle a bit more, that’s the environment the portfolios will work hardest for you.

Market Outlook

Our expectation continues to be that global growth is now sufficiently self-sustainable to handle the reduced stimulus from Central Banks. We are witnessing a period of rare synchronised expansion; with corporate profits rising, trade expanding and robust growth in the US, Europe and Asia. Many commentators are labelling this as the “Goldilocks” period for equities.

However, while it is easy to be over optimistic with this backdrop, there are still several scenarios going forward which could upset the positive view. To name but a few; policy error by Central Banks, increasing tensions between the US and North Korea, uncertainty surrounding Brexit and a sudden spike in inflation, are all on our radar. Therefore, there are reasons to remain cautious going forward.

Risks surrounding the US retain our attention. While it should be much of the same from the US Central Bank, it is still a big ask to start reversing the supportive policy they have had in place since 2009 without upsetting the equity markets.

Trump’s anticipated Tax Reform was initially well received by the markets, however, we have since witnessed the US Dollar fall to a 3-month low as the market weighs up how much of a positive effect the Tax Reform will really have on the economy. This is not a trend we see continuing into the second half of 2018 as inflation should start to come through in the US.

Japan is still flavour of the quarter, and with the re-election of Prime Minister Shinzo Abe in October, we should continue to see much of the same support. The Japanese stock market is still one of the better value equity markets available; a major tailwind at a time when most are severely overvalued on a historical basis.

Europe managed to sweep away most of the political risk anticipated throughout 2017. With only the Italian election to manage through in 2018, the European equity market looks set to build upon its robust performance witnessed in the last 12 months, hence Europe remains our greatest conviction. All eyes will be on the European Central Bank though, as they have the potential to distort things significantly as they decided whether to remove their supportive policy or not.

Some headway was made in the Brexit negotiations late last year, with the European Commission satisfied about the significant progress in the first phase of negotiations. However, formal negotiations can now begin on a transition period from the end of January, so whilst the December boost will have subdued some of the uncertainty for a short period of time, we have little doubt that “phase two” of the negotiations will generate similar levels of speculation.

Staying here at home; on May 3rd Britain will go to the polls again to cast their ballots in the local elections. As many will take this opportunity to reflect their opinion on the current UK government there could be yet another snap general election on the cards. This only further emphasises our mandate to be highly selective in the UK equity market given the significant upcoming risks.

Opportunities continue to be very limited in the fixed income space, especially as we enter a cycle of rising interest rates across the developed economies. However, there are still opportunities in Emerging Market Debt and therefore, this asset class continues to be our main conviction call in the fixed income space.

In summary, 2018 looks set to be similar to 2017; an optimistic outlook but with a variety of low probability, high risk events scattered throughout the year. Therefore, it is important to not get carried away with the optimistic outlook and maintain our cautious mandate. We are convinced that, as such, the portfolios are positioned to capture most of the upside but will still preserve capital should markets fall.

*Source: FE Analytics

**DB Wood, Financial Express. Figure provided are given gross of our advice costs and Standard Life’s platform costs and are quoted at model level.

Categories

Recently Written

Join our mailing list