Ashley Brooks

5th October, 2018

IC Insights

Investment Review Quarter 3 2018

Market Review

We finished our last quarterly update expecting a challenging third quarter for both equities and bonds. Both markets emulated UK weather patterns, as once the beautiful weather we saw in April through July subsided, cloudier skies took hold. The winds mostly blew in from the US, with Trump escalating his trade fight with China, but domestically, Brexit noise has also been a central issue.

Economically, things have remained robust. Global growth hasn’t quite reached the heights seen in 2017, but it hasn’t been bad either. Not too hot and not too cold would be a fair characterisation, which is a decent place to be. But as we have said before, markets aren’t struggling because of the global economy – the withdrawal of the huge support lines that policymakers have put in place since 2008 is dominating. We therefore remain in this unusual period of time where asset prices are “normalising”.

Interest rates are now going up. In August the Bank of England raised the benchmark rate to 0.75%, and the US central bank have continued their policy of one increase per quarter. These moves are justified based on the solid data we are seeing –the economic picture in the UK is significantly better than the papers would have you believe – but this still acts as a pull on markets.

Then we have the never-ending actions (and tweets!) out of the US administration. A key reason for Trump’s election was the votes of the US middle class, many who have either lost jobs or seen low wages on the back of globalisation and the outsourcing of manufacturing to China. Whether you like him or not, his “tough on China” campaign is trying to satisfy the wants of those who voted him in. For markets, the friction causes concern and uncertainty, so again this has been a challenging issue.

Here in the UK we are still no closer to understanding what things could look like post-29th March 2019. Things change week to week, although we have seen a slow trend towards people believing there is at least a bit of progress in talks. Ultimately, our view that we are unlikely to know more before the 28th March remains, stopping benchmark markets moving higher.

However, the gloomy picture doesn’t mean there haven’t been returns to be had. It is more that at the market level you aren’t getting much help anymore. Instead, you have to look deeper and be more specific with your ideas. Next we breakdown how we have managed to achieve a good quarter of returns in this environment.

Portfolio Review

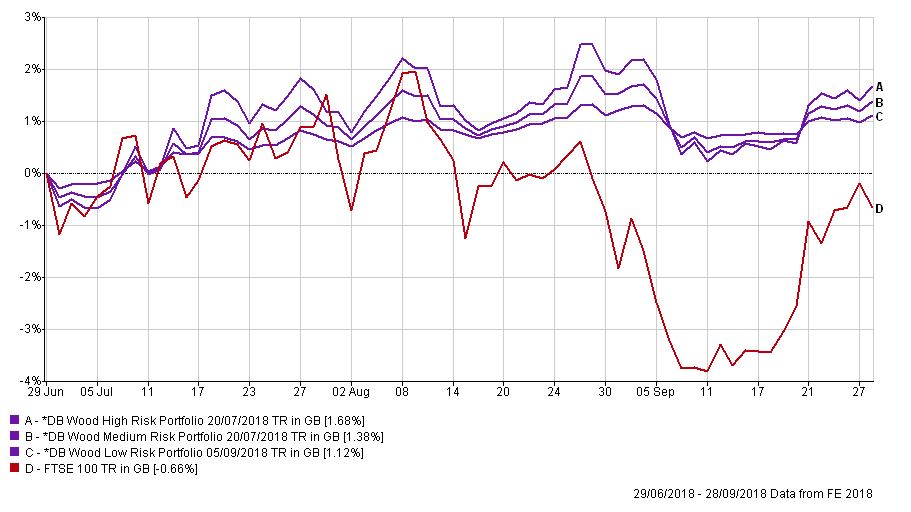

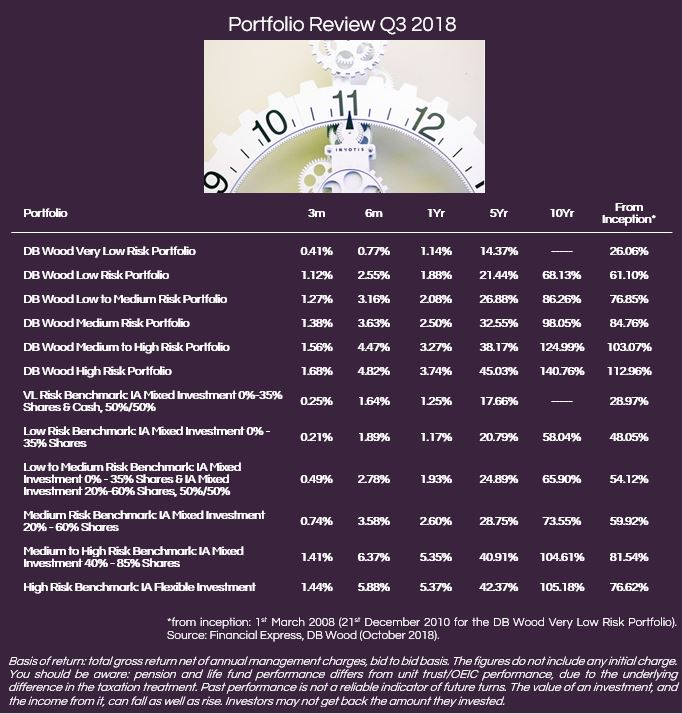

The portfolio range returned between 1.12% (Low Risk) and 1.68% (High Risk) in quarter three, outperforming benchmarks by 0.6% on average in just three months. Year-to-date returns sit at similar levels, but given that the average lower risk portfolio would have lost you money in 2018, this is a good outcome in a relative sense.

For some time we have believed that the economic and market picture will remain tricky, choosing to dedicate our resource to finding fund ideas to generate extra returns. As an example, we have a consistent theme of preferring smaller companies over large in our equity bucket. In our view Trump can do very little to hurt the price of Fevertree, the mixer maker that has taken the market by storm. Focussing on companies that excel in their niche industry can therefore be a big plus in times like these.

We have also held a record underweight in bonds, an asset class that we are negative on given rising interest rates. For your reference, the benchmark of our Low to Medium Risk Portfolio holds 43% in bonds in comparison to our 17%. With UK bonds showing a -2% return year-to-date this has been a big plus.

Avid readers and long term clients will note that we tend to have a structurally high weighting to UK commercial property, which remains a favoured asset class. There is no doubt that Brexit noise is a concern, but while we wait to see how things evolve, we have been happy to receive the unmatched level of income here. From this bucket, we will probably achieve around a 5% return in 2018.

Overall, the culmination of these different decisions have produced a solid result in a challenging environment. We see many of our peers pushing risk out in order to try and eek a little extra return, something that is not in our client’s best interest and therefore not in our DNA. Instead, our outperformance has come from our active and flexible approach. In challenging markets such as these, history suggests this is rewarded, and we have huge confidence that in these times your money is best placed with us.

Market Outlook

We have now entered a new phase for investment markets. The focus of policymakers has shifted from support to protection. The global economy is still growing but is slowing. There are however, no signs that the typical imbalances you would see preceding a recession are on the horizon, though we remain vigilant. There is no over consumption, no overinvestment, and in general no obvious overheating. High levels of employment are at last starting to result in the emergence of wage rises in certain sectors, and with potential worries around trade wars there are concerns about inflation rising. All this adds up to a slightly bumpier ride for markets – the nice smooth motorway has been exchanged for a B road, potholes and all. B roads have their advantages though. Not everyone is heading the same way, and there are some lovely views in certain parts. As a result, we must work hard to seek out opportunities. What has worked in the past is unlikely to in the future – this is when we should demonstrate the benefit of the investment flexibility we offer.

2018 has marked another good year for the US stock market, one which has seen it break-away from the rest of the world. This is not difficult to explain, as it is a direct result of US fiscal and trade policy. The tax cuts Trump announced late last year have allowed companies to buy-back shares, pushing their prices up, and the trade spat has hurt non-US markets, causing a large divergence. The UK and Europe have doubtless been affected by Brexit and have offered very little equity growth over the last 12 months. Looking forward it is still very difficult to call this outcome due to all the political noise. Caution is therefore required, though an opportunity will doubtless emerge, one way or another. Moving forwards, those tailwinds in the US are likely to start to filter out, and as interest rates start to bite, there is the chance that other markets catch up.

In stark contrast to the US, many investors overlook Japan. The outlook here remains positive with Abe re-elected as Prime Minister after a landslide victory on the 20th September. Q3 earnings will also start to be published over the next few weeks. We expect the Japanese market to have a strong conclusion to 2018 excluding any unexpected escalation in the trade spat between the US & China. These are the type of regional ideas we are looking for.

The fixed income market continues to be the most challenging pool to fish in. Traditionally this asset class forms the lions share of our cautious portfolios, however, we are currently at our lowest level of exposure since we began running these portfolios over a decade ago. While the economy remains in the growth stage, Central Banks are going to try and steer interest rates back towards “normal” levels. Fixed income is sensitive to rate rises, but there are still selective opportunities depending on your long-term view for economic growth and for inflation. For the main we are concentrating on short dated bonds, and bonds which benefit from rising interest rates, such as Floating Rate Notes.

Commercial property remains a stable asset class despite the recent falls in UK House prices. We remain at higher levels of allocation throughout our portfolios. In general, we are taking a more tactical approach to portfolio management. We expect markets to remain volatile, so as they rally we will be tweaking risk levels down, and as they fall we will be buying in. The combined effect of this across a year can make a big difference to our clients’ outcome.

Overall our outlook for the rest of the year and beyond is not dissimilar to last quarters. Things will remain bumpy as interest rates normalise and inflation is a risk we are focussing on. But despite these worries, economic fundamentals continue to remain solid. There are good returns to be had, but we need to continue to be selective and flexible. As always, we remain diligent during this time of heightened news flow, avoiding being swayed from short-term events, and instead using them as long term opportunities.

Categories

Recently Written

Join our mailing list