Ashley Brooks

13th July, 2018

IC Insights

Investment Review Quarter 2 2018

Market Review

Just as Q1 marked the return of volatility to investment markets, Q2 showed it was here to stay. Trade wars V2 commanded most of the headlines, as Trump continued to try and disrupt global balances. For us though, it has been very much about not believing everything you read, separating the wheat from the chaff.

What Trump says and tweets is of course important, but we have often seen him follow the mantra of “make threats, strike deals, and declare victory” since he joined the US administration. It does not seem long ago since the world was worried about the size of his and Kim Jong Un’s respective nuclear buttons, and now both countries are at peace for the first time in decades. Now just because that one worked out, doesn’t mean trade threats will follow the same path. However, in our view it is in no one’s interest to become enemies and as long as Trump can be seen to be carrying out his campaign promises by simply threatening, his popularity at home will stay high.

What do we think is actually driving markets then? Well for years we have been discussing the extraordinary central bank policy that has consistently supported markets for well over a decade. Here we are referring to the ultra-low interest rates that we have seen globally and the printing of money to stimulate economies. This has pushed up the price for nearly all assets (something that we will refer back to in the portfolio review section), leaving investors well compensated for investing their money.

For some time though, it has been clear to us that this policy stance is changing, and it really is a sea change – from very supportive to restrictive. The US is further along than most, but the key point is that globally, central bankers are slowly removing the markets’ life jackets. This, in conjunction with slightly less positive global growth data, is the real reason volatility has returned.

On the latter point, Q2 also saw a significant shift in the general trend of economic positivity, with data from Europe, Japan and Emerging Markets showing slight weaknesses. It is important to note that this is more of a slowdown from 2017 highs, rather than something more sinister.

The UK looks quite well situated away from the global story. The path to Brexit has started to become a bit clearer (although we won’t deny that there is a lot more work to be done) and the key pillars of the economy are all pointing to a relatively positive picture (I emphasise ‘relatively’). Annual wage growth now exceeds inflation for the first time since late 2016, the government have repaired their balance sheet to a good position and bank lending looks solid. That’s all before we consider the economic boost from the England football team’s recent performances!

So to summarise, Q2 was a tricky quarter. Equity markets bounced back slightly from the very poor first quarter but remain close to par year-to-date, the economic picture deteriorated from recent highs but the trend remains positive and Trump made some more statements. Underlying though, the slow process of normalising central bank policy continues to make things challenging and has profound consequences for the way we manage portfolios.

Portfolio Review

Over the last ten years we have made strong returns from lower risk assets (bonds), as capital values have risen on the back of Central Bank support. However, as outlined in the last section, the variation in policy stance from monetary easing to monetary tightening is a crucial change.

We have been monitoring this risk for some time and have been reducing our holding of lower risk assets as they become expensive, steadily taking profits. After all, it is the price you pay for something and the price you sell it at that determines the return.

Under normal circumstances we would be reinvesting the proceeds of these assets into other areas. However, at the current time, there is little opportunity to reinvest where the risks are appropriate. Most markets are both risky and expensive – not a good combination for future returns. As the policy change unravels and interest rate forecasts rise, lower risk assets are likely to offer negative returns. We are therefore currently holding more cash than we would normally like, but will use it actively as soon as we start to see better value. An important point for our clients to note, is that given this scenario we expect returns from our lower risk portfolios to be at the lower end of our forecasts.

Faced with this realisation, we have the choice of following our peers and increasing the risk in our portfolio’s (many are ramping up risk by investing more in equities), but at this point in the cycle and given the level of volatility, we are not comfortable with that strategy. Our job is to maximise the chance our clients achieving their target returns over the long term, and not to take a dart board approach to investing!

So, for the time being we feel markets are more about capital preservation than capital growth. We have restructured our portfolios to reflect this and believe it is important to be patient and wait for the opportunity to make money, not chase returns. As always, we are absolutely committed to adding value where we can find it, being patient with your money to ensure the best outcome over the longer term.

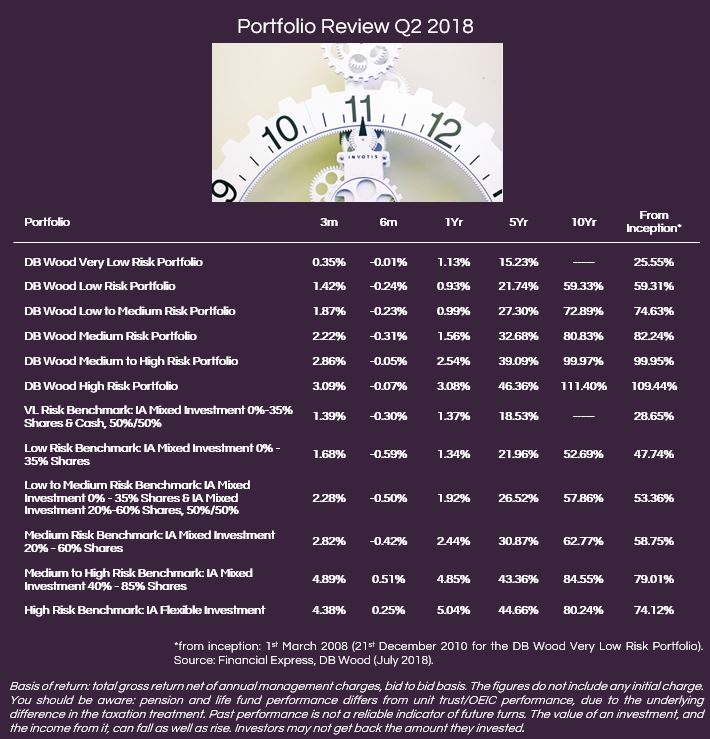

In terms of specific results, it was a positive second quarter for the portfolios, as they returned between 1.33% (Low Risk) and 3.00% (High Risk). Taking into account the challenging first quarter, this leaves the portfolios around flat year-to-date.

As we discussed in our last quarterly outlook, Q1 was our most active quarter ever with respect to portfolio changes. As markets sold off and become cheaper, we used it as an opportunity to add to equity areas where we were convicted. As markets bounced back from those lows in Q2, the portfolios benefited.

Outside of the equities, UK Commercial Property provided the most positive contribution to the portfolios. Year-to-date this asset class has returned 2.8% (Source: Financial Express, DB Wood), and we fully expect this to approach 5% before the end of the year. We have held a much higher allocation than our benchmarks in property for some time, so this has helped overall performance.

Moreover, it is pleasing to see that the combination of our various changes across the last 12 months have added value to the portfolios. Specifically, if we had made no changes at all, clients’ returns would have been 0.63% lower on average. This is just one of the many ways we try to benchmark our success, but nonetheless we hope it helps to outline the benefits of having an Investment Committee constantly monitoring global themes.

Market Outlook

Our expectation is that the volatility witnessed in the first half of 2018 will continue into the second half of the year. In select areas, economic growth and corporate earnings remain on trend, highlighting the continued necessity to be selective with our asset allocation.

Our attention focuses on the risks which could force global growth back below trend and cause a recession in the medium-term. While there are many events to consider, such as the US’ trade spat with China and of course, Brexit, we believe that these politically driven headlines will simply continue to generate noise; keeping market volatility higher than has been seen over the last 18 months, creating opportunities.

Central Bank policy decisions remain in focus, as was the case last quarter. Whilst we believe that the US Central Bank will continue with their agenda of one rate raise every quarter, the predictability of European policy is a little trickier. This creates uncertainty, which we believe will be a headwind to European assets in the short-term.

While Europe managed to sweep away most of the political risk anticipated throughout 2017, that has not been the case in 2018, with the Italian election causing a major shock through the European market. While the sentiment has settled in Europe (when a coalition was formed on the 1st June), political tensions remain high in the single market, providing further justification for our recent reduction in allocations here.

We remain convicted to Japanese equities. While the Q1 data was poor for Japan and market sentiment was severely damaged on the back Trump implementing tariffs on Chinese and European goods, the corporate environment remains as positive as it was in 2017. In June, the government announced further requirements for businesses to achieve sustainable growth, further boosting the outlook for Japan.

In the US, the positive economic environment looks set to continue at or slightly above trend, especially as the effects of the Trump tax reform (which came into effect on January 1st), begin to filter through into companies’ earnings figures. While parts of the US market remain expensive, there are areas in the domestic market which are better value due to the continued supportive backdrop.

Despite the UK market being boosted by the rising oil price, investors remain focused on the outcome of Brexit. At times the path of Brexit has looked clearer than at others (such as in Q2), however, we believe the path will remain unclear until we are closer to the 21st January deal deadline. In contrast, the economic environment remains positive, with the Bank of England continuing to be supportive in their policy stance and economic growth solid. We therefore believe the UK provides a good opportunity set in comparison to the rest of the world.

Fixed income markets remain challenging and will continue to be so for the rest of 2018 as interest rates continue to rise globally. As discussed extensively in our portfolio review, we are trying to stay diligent with our allocation to low risk assets whilst these factors play out. There is not an easy solution here, so we are focussed on selecting the best funds to navigate the tricky times.

In summary, the next quarter of 2018 is likely to be another challenging one, with risks to equity and fixed income markets remaining high. It is important in times of increased volatility to stay focused on the long-term and not be swayed by short-term movements and noise. Rest assured, we are working harder than ever to uncover opportunities but will not diverge from our mandate of protecting clients’ capital. In turn, we believe this will provide a springboard for us to continue achieving our strong longer term track record over the years ahead.

Categories

Recently Written

Join our mailing list