The Investment Committee

6th April, 2018

IC Insights

Investment Review Quarter 1 2018

Market Review

The first two weeks of 2018 saw a continuation of steady growth within investment markets. Although many of these markets were trading near to or at all-time highs, economic data still appeared relatively supportive of further growth. However, history has taught us to be fearful when people are greedy, and greedy when people are fearful. As such, we were not surprised to see a significant correction and consequent volatility increase from mid-January onwards.

It is human nature to try to understand the world around us. As an Investment Committee, we update a list of the major perceived threats with an assessment of their potential effects and how we could counter them most appropriately. In this instance, markets became uncertain about companies maintaining profits in a world where inflation rises; pushing interest rates up, consumer spending down, and thus causing a knock-on effect to company profitability. Secondly, central bank “support” is reducing, pulling off the markets’ comfort blanket. We are moving from a world where Central Banks have provided capital to markets whilst economies recover, to one where they feel they have done their job, and are unwinding that position.

In addition, fears of a global trade war were very recently fuelled as Trump imposed import tariffs on aluminium and steel. A trade war is essentially the opposite of globalisation which is perceived as being positive for growth and productivity. If China reacts, and things escalate, this could be a restrictive force on growth over the years ahead. It started in Q1 but is way too early to understand the full consequences. Where Trump is involved (and other notable political celebrities), their rhetoric alone can be enough to spook markets.

So the outcome for our major markets was that the UK top 100 companies by size (FTSE 100) finished the quarter down 7.21%, a weighted average of global stock markets (MSCI World) was down 4.8% and a main fixed income benchmark (IA Global Bonds) was down circa 2%. The former wiped out the majority of its gains from a stellar 2017 in just a few weeks. Also, the fact that both equities and bonds (the two core asset classes in multi-asset portfolios) fell together emphasises the challenge facing investors. These two should go up and down in different directions in most environments, but rising interest rates poses a threat to both. Equities should be slightly better positioned, though inflation needs to be accompanied by rising profits, and this trend remains uncertain.

Coming back to the economic backdrop, there was nothing in Q1 to suggest that things were slowing down. US growth hit 2.9% year on year to start Q1, beating expectations, and corporate profits were boosted by tax cuts that were agreed late last year. The UK made progress on its Brexit transition arrangement, and didn’t even need a deadline to get things moving. Outside of the Western world, China also made promising steps towards a sustainable growth path, something that markets were very worried about in early 2015. Finally, in recent weeks, positive developments between Trump and Kim Jon Un suggest their feud may be starting to abate.

Overall, whilst economically things continued to be very positive, markets endured their worst quarter for 5 years. Led by fears of rising interest rates and a global trade war, investors quickly became concerned, and both main asset classes suffered. In the market outlook we will discuss whether we feel this correction has further to go, but one things for sure, Q1 ensured volatility was back!

Portfolio Review

We are happy to have seen the return of volatility to investment markets; it is a normal part of healthy markets. Our many long-standing clients will acknowledge that we have made excellent returns over the last 10 years by protecting our portfolio’s when wider investment markets sell off, allowing us to pick up value and opportunity to correlate more closely with the same markets when they recover. The last two years has seen an absence of volatility on a comparative basis, and as such, given that we felt markets were generally expensive, we have held low exposures to risk assets expecting a correction.

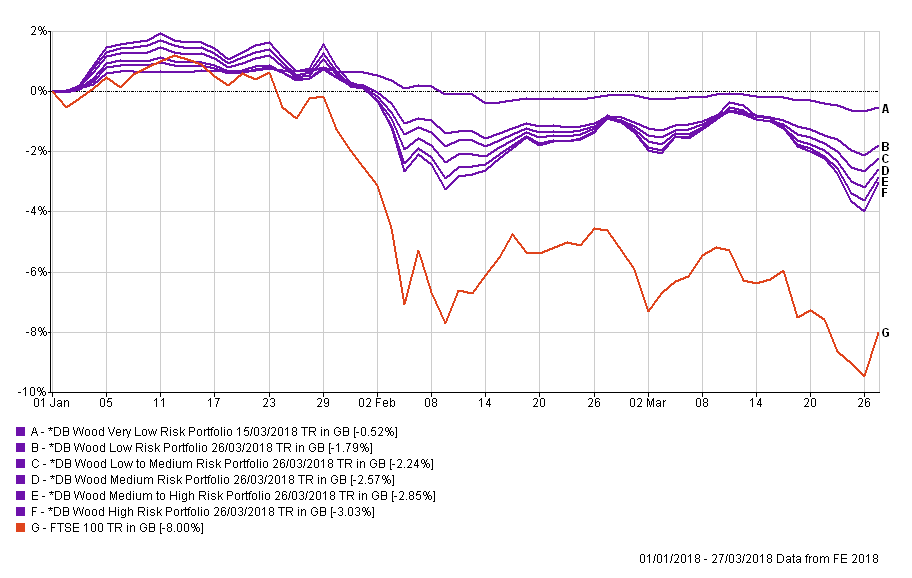

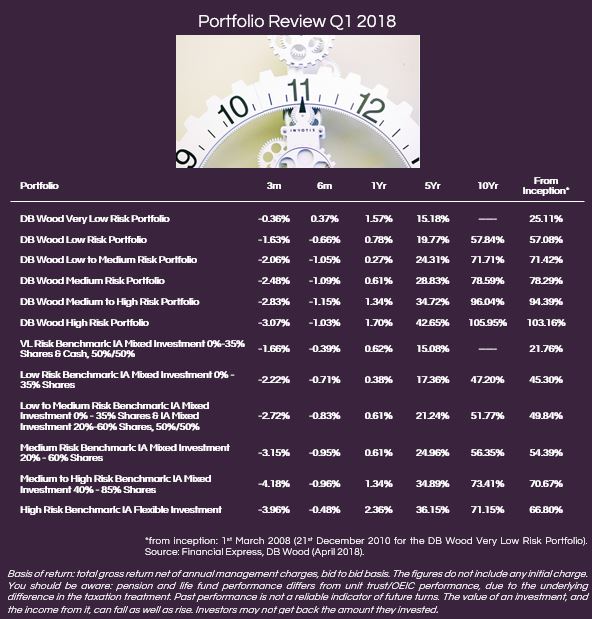

With hindsight, we were predicting a correction a little too early, however, when it arrived in January, we were well positioned and consequently, although net returns on the quarter were not positive in any of our portfolios, all six held up as we would have expected, and significantly better than their respective benchmarks. If we can protect investors capital on the way down and use any correction as an opportunity to add to areas we like at cheaper valuations, this can create great future returns. We are delighted to say that from this perspective quarter one has been a success.

Given its an environment that better suits our philosophy, it has not surprised us that in relative terms (vs benchmarks and peers) we outperformed in the first quarter. We believe we are set-up very differently to them, and the level of protection across the portfolio range (as illustrated by the chart below), was achieved by a combination of factors. When investors were getting carried away in January, we were moving money into cash. We also generally hold more of our portfolios in alternative assets than most, to provide increased diversification. Therefore, Commercial Property and our Absolute Return holdings in particular contributed positively in the first three months of the year. Finally, markets which are less exposed to developed world policymakers, such as smaller companies and emerging markets, which depend on different factors to drive their share prices, were also well placed. We had been adding to these areas across 2017, so we were pleased to see the story start to play out.

Q1 2018 marked our most active quarter ever in terms of portfolio changes. The movements into cash that we had made were redeployed, both into equities and into Commercial Property, which we continue to favour. Essentially, we have been able to add to the areas where we have heavy convictions, at cheaper valuations. When markets bounce back from here, we feel we are very well placed to benefit.

Whilst the first quarter may not seem positive on face value, it was one where we worked extremely hard for our clients to ensure they were protected when markets sold off, and well positioned to benefit should they rally back. Often these periods are vital in achieving the return targets that we set over a rolling 5-year time horizon, and as always, we will keep working diligently with this in mind.

Market Outlook

The future is always uncertain, so it is important to try to understand the various scenarios that could unfold. Moreover, when you aim for consistent performance, you cannot place all your eggs in one basket, and therefore need to allocate sensibly.

Our central case is that economically things remain positive. Growth should continue to be above average in 2018, corporate profits strong, and the burden on consumers should fall as wages pick up and inflation remains muted, or even falls in the UK as 2018 develops. This doesn’t mean that markets will race away. Central Banks will continue to withdraw support – we expect the Bank of England to raise interest rates by 0.25% in May, and the US to move on at least two more occasions this year. So the trade-off between positive economics and tighter policy will continue, but we expect the key policymakers to make sensible and measured decisions. Overall, we think it’s a solid backdrop for good companies to deliver, provided no surprises occur.

There are of course various things that could upset this outlook. In the short term, the most likely threat is an escalated trade war between the US and China. That would reduce the outlook for global growth and cause investor nervousness. There could also be more isolated issues… yes, the Brexit transition deal is a positive step forward, but we still have a lot of hard work ahead of us. Any central bank that moves too quickly would also cause worries in that specific region. Finally, we want to keep a close eye on inflation data, as this could dictate market confidence.

So if markets rise again in the short term, we will not be getting too carried away. We will more than likely look to take profits, expecting further volatility ahead and preferring to put that money to work again when a similar opportunity presents itself.

To cover our longer term view on markets, we are certainly much happier with valuations than we were two months ago. Here in the UK, and even in overseas regions like Japan, equities now look reasonable value when compared to long term history. Importantly however, there is no sweeping generalisation – other regions like the US still look richly valued – so we have been very specific as to where we allocate.

Fixed Income markets remain challenging, as the return on offer is low, and often doesn’t compensate you for the risks taken on. We have been reducing our Fixed income exposure consistently over the last 12 months, and whilst we don’t think interest rates and inflation will spike, their momentum is generally upwards, and this is bad for this asset class.

Therefore, we prefer equities over bonds, but to ensure good diversification, especially in the lower risk portfolios, alternatives such as Commercial Property and Absolute Return become more important. With respect to the former, we retain a positive outlook, based on a solid (but not excellent) UK economy and the fact that the funds we hold are providing a very attractive income yield comparative to all other major asset classes. In the latter’s case, we have spent a lot of time as a team trying to allocate to geographies and strategies that could add significant value as the year unfolds.

So to summarise, economically we feel positive, but there are countless events that could ensure volatility is here to stay. Valuations in equities are more attractive, and we are working hard to utilise good opportunities elsewhere as well. We therefore expect it to be a choppy year, but are optimistic about the level of opportunity now on offer. We will remain nimble and active, working hard to protect clients on the downside, using the volatility to our advantage.

Categories

Recently Written

Join our mailing list