The Investment Committee

28th February, 2020

IC Insights

Coronavirus – An Update from our Investment Team…

This week will finish as the worst week for equity markets since the global financial crisis in 2008. We can’t argue that the rise in case numbers and geographical spread hasn’t increased the need for concern, but we must also consider that the media hype spreads fear and can cause oversized market moves.

Whilst it is a tragedy that any fatalities have come from the Coronavirus, it is important to remember that the number of cases and mortality rate (estimated at between 1% and 2%) remains low compared to other illnesses. As an example, it is estimated that so far in 2020, 78,025 people have died from normal flu, compared to 2,869 for Coronavirus (Worldometer, 2020).

Moreover, whilst the economic consequences shouldn’t be ignored – in fact it is now almost certain that the global economy will slow significantly in quarter one – it is also encouraging, that after just six weeks the most affected areas in China are showing signs of returning to normal life.

The hope therefore, is that the arguably better health systems in the western world, in addition to an improved understanding of the virus since its outbreak in mid-January, will provide a better platform for containment and control.

However, it would also be wrong for us to ignore the risks. Given the virus’ infancy, especially in western economies, it is difficult to predict even some of it’s most basic characteristics. The incubation period has been estimated to be between 2 and 27 days in some cases, and we still do not know the most effective means of transmission. Comparisons to flu are therefore reassuring but flawed, as there are still too many unknowns at this point.

Moreover, it is even more difficult to assess the knock-on effect on economic growth and company profits, which to a large extent depend on how long a resolution takes. Even if the virus remains well contained in the western world, it is still going to be very difficult to police without significant economic damage.

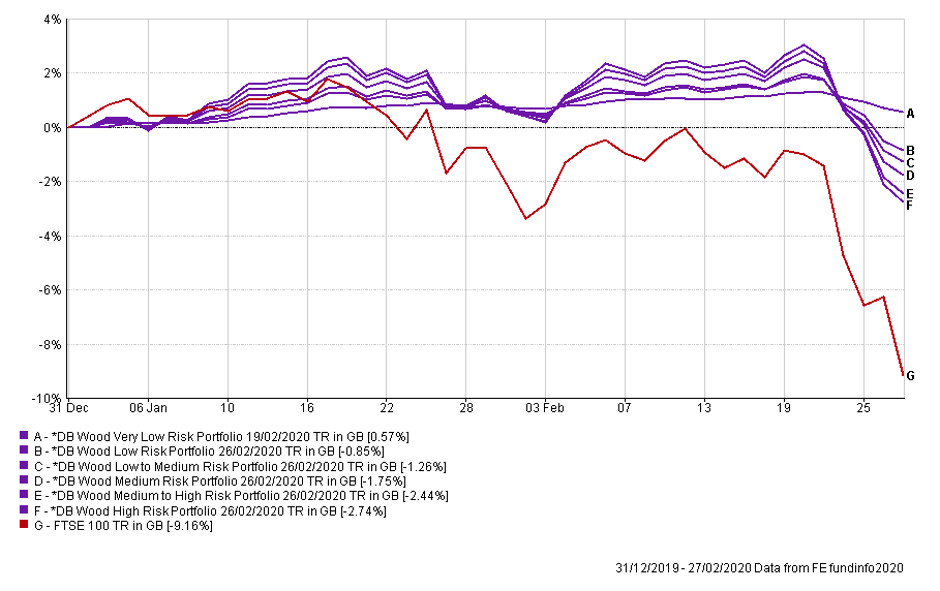

With respect to portfolio performance and positioning, we are pleased to report that the downside protection displayed in recent weeks has been strong. This is not a surprise, given our general focus on diversification and discipline. As the chart below illustrates, year-to-date our Low and Low to Medium portfolios have lost 0.85% and 1.26% respectively, compared to the wider UK equity market which has returned -9.16%.

Finally, as we look out from here, we remain cautiously positioned with good downside protection in place. However, it is important to mention that we will always be vigilant to both short term risks, as well as long term opportunities. We remain committed to navigating these challenging markets on our client’s behalf, and will remain active and diligent in our approach.

Categories

Recently Written

Join our mailing list