DB Wood Team

25th January, 2019

Hot Topics

Brexit – Where do we go from here?…

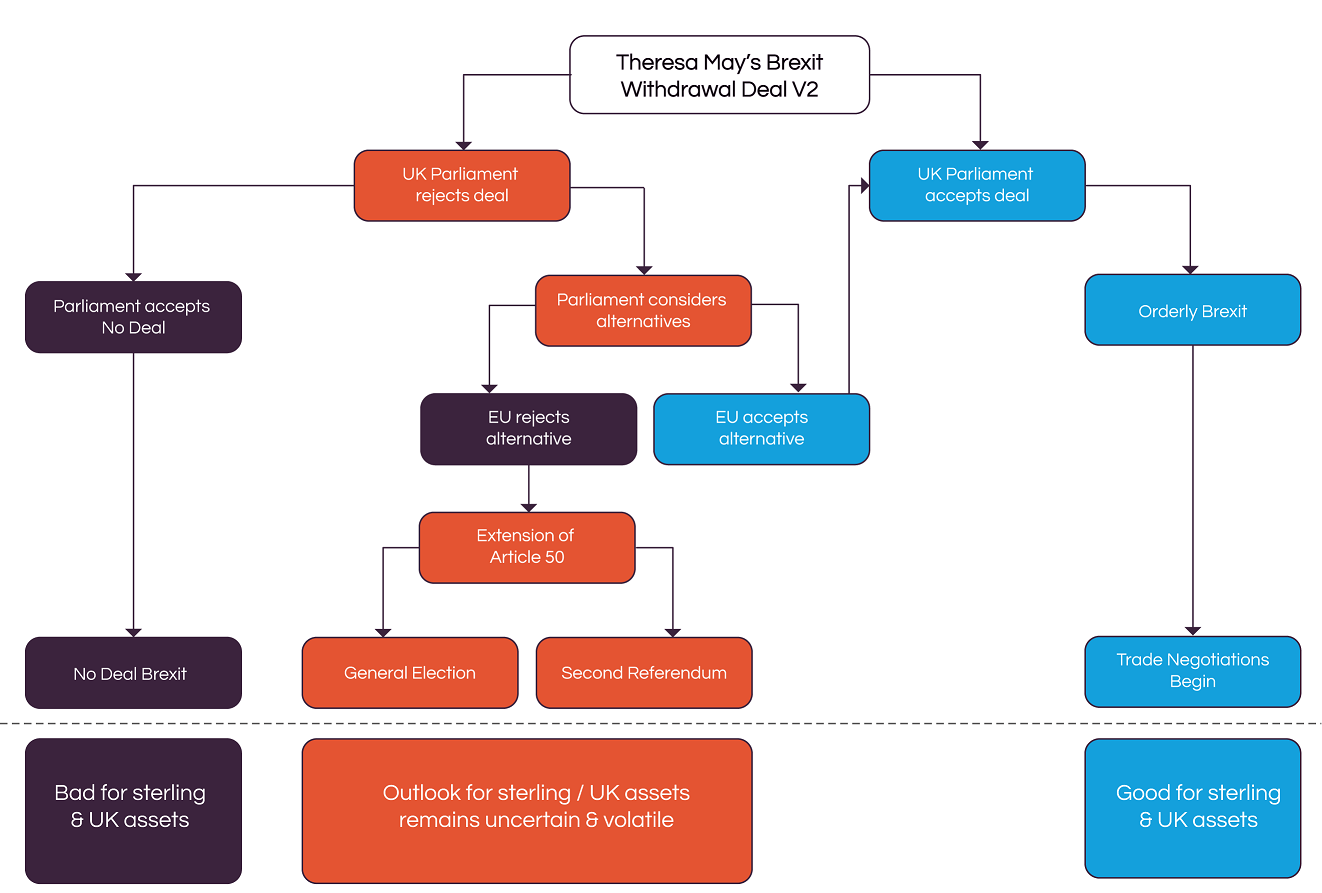

I know, by now just hearing the word “Brexit” is frustrating! Why can’t the politicians come together at a time when the country needs them to? Putting the people’s needs above their own was what they were elected for right? Then again, in such a closely contested vote, it is not a surprise that it is so hard to find a solution that’s acceptable to everyone. In any case, as the uncertainty continues, and with Parliament seemingly unable to find a consensus for the time being, we thought it would be helpful to provide a visual of the various possibilities from here.

Whilst MPs are struggling to agree a route down the blue path (see above), over the last few weeks they have also been keen to rule out a no deal. Specifically, it is our view that there would not be a majority in the House of Commons for a no deal Brexit, so this remains an unlikely outcome. However, there would also need to be significant changes to May’s current deal in order to vote this through, so further amendments could occur as the clock runs down to March 29th.

Irrespective of this, unless there is significant change, it is unlikely that parliament will place a majority behind Mays deal. As we approach the deadline, the government will be looking to attain some compromise from the Labour party, who seem more concerned with pushing for a general election than finding the middle ground. We don’t think a general election is likely in the short term, and if it did occur, would only serve to weaken our negotiating position with Europe.

Although a second referendum has its critics, as time progresses and Parliament struggle to find a consensus, it becomes a stronger possibility. However, it is not our central view, as it would serve to delay the Brexit process further, increasing uncertainty and dragging on UK and European economic growth.

Given these challenges, we should not be surprised to see the uncertainty continue over the coming months. From a portfolio perspective, fortunately Brexit is not the major influencer of returns. We consider the opportunity set globally, and remain balanced and diversified across regions and asset classes. So whatever the outcome of Brexit, our portfolios remain well protected, and nimble enough to take advantage of the opportunities that ultimately will be created.

Categories

Recently Written

Join our mailing list