The Investment Committee

1st May, 2020

DB News

A Slow Release Valve…

We are over the peak according to Boris and his team of scientific experts, and can look forward to details next week about how we might begin the journey towards normality. Timing wise, we are around two weeks behind mainland Europe, and as their tentative steps show, normal (as was), is some distance away.

We know from our research and feedback from trade associations, that Federations and bodies across the scope of the UKs’ employment sectors, are setting out their plans to return to work at some point through May and June. The timing specific to each sector will depend upon several economic factors as well as the impact that they might have on the R number (effective viral reproduction rate). So, it will be like watching a baby take it’s first steps. We will need to show patience, and not try to run before we can walk.

After a strong run from the bottom of the market in mid-March, investors in the last few days have started to realise that the economy is not going to bounce back quickly. The job cuts and salary reductions announced this week by the likes of British Airways show that whilst it should pick up, margins will be tight, profits severely weakened, and consumer spending held back for some time. Its not all doom and gloom, things will improve. There are also sectors which are benefiting, to some extent compensating for those that are not, though as in any recessionary cycle, there are more losers than winners.

Our view was always that markets would react positively to the stimulus provided by governments and central banks in recent months. The negative narrative in March would turn, and they might think the lockdowns would allow us to re-introduce quickly. As we moved towards Christmas, there would then be every chance the economy would be accelerating towards full capacity. However, this has become much less likely in our view, and markets have gotten slightly ahead of themselves.

In order to stop a second wave, the scale of reintroduction is sure to be on the cautious side, and so we cannot expect real economic progress until we have a vaccine. Even in the most positive scenario where Oxford University come through at break-neck speed, we are still some way away. Moreover, whilst the initial stimulus provided by Governments is positive, so far it has been more life support than traditional stimulus. Lots more will be required over the months and years ahead to get things going again.

To this end we have been adding protection to our lower risk portfolio’s in the last week. We must be careful we don’t take too much risk off the table, as if our central case is wrong and let us say herd immunity is higher than we think, then markets could move forward, and we could miss opportunity because we are too defensive. Moreover, there are selective areas where the opportunities are still excellent, so we want to remain exposed to benefit here. Overall, we feel we have the right balance of downside protection in place, without giving away chances to benefit when things ultimately improve. There is certainly a fine line here, and we remain focussed to find it.

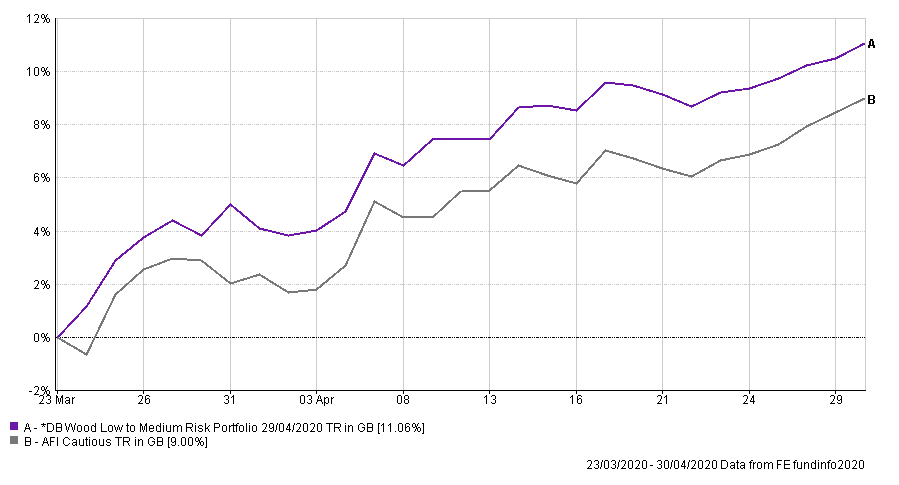

So how are we doing? Well, one of our measures is to see how we fair against our peer groups. The Adviser fund index is a measure of leading wealth managers in the UK, so it’s a reasonable point of reference. The graph below shows our route forward from the bottom for investment markets in late March, though on the journey to this point, it is also worth mentioning that we protected more effectively, cushioning by 1% versus the index. As you can see, since then we have produced greater upside, with Low to Medium gaining 11.06% compared to the Cautious index at 9%. That combination of better downside protection and better upside participation shows we are finding the right balance.

The environment continues to evolve though, and so in many ways, Governments round the world face the same challenge as we do (though ours is not life and death….) in adjusting their strategy to the various forward risks and rewards. In their case, if economies reopen the R number will rise (helping herd immunity), though it cannot be allowed to rise too high as another uncontrolled outbreak would lead to further shut downs, deepening the depression. Just as we have ours in the portfolios context, this is their fine line. As the engineering sector and many others look ahead towards a return to work, slow release valves are certainly in demand.

Categories

Recently Written

Join our mailing list